If you’ve ever envisioned how to start a crypto exchange business, you’re not the only one. Many people are interested in getting into this lucrative field, but it can be challenging to know how/where to start.

The process of starting a Bitcoin exchange business can be both challenging and rewarding. However, the benefits of starting one are numerous, including a better chance of making money compared to other crypto-related businesses.

To get started, you need a solid crypto exchange business plan, a proper revenue model, and the right marketing strategy. These are essential components to turn your idea and ensure long-term profitability.

Building a successful crypto exchange business is a long-term process, and keeping up with the latest trends is crucial. To provide you with the most up-to-date information, we will be continuously updating this edition.

So don’t forget to SUBSCRIBE at the right corner to receive updates on this topic in the future. Now, let’s dive into the step-by-step process of starting a crypto exchange business.

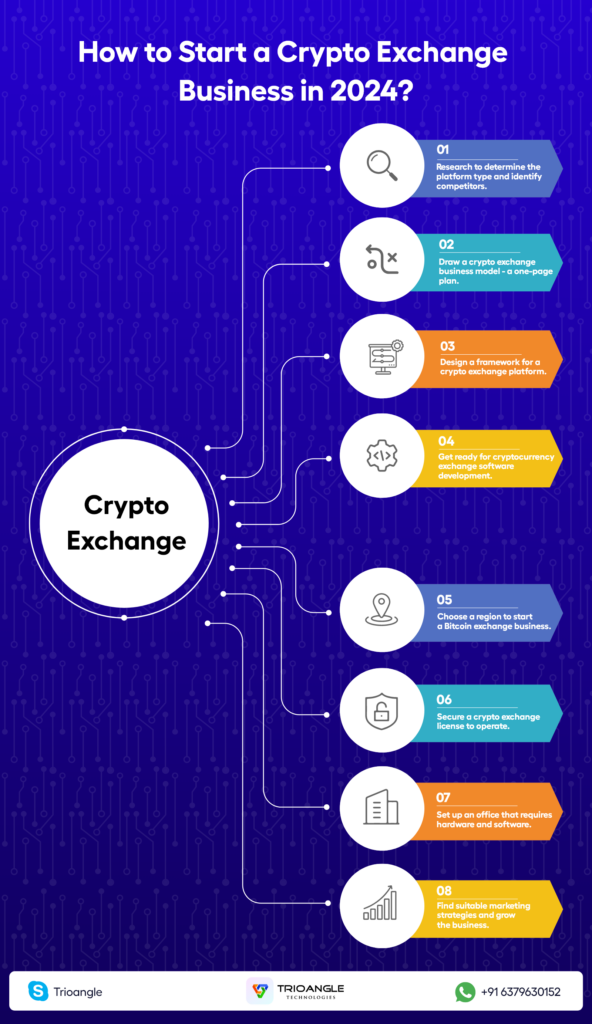

How to Start a Crypto Exchange Business in 2024?

- Research to determine the platform type and identify competitors.

- Draw a crypto exchange business model – a one-page plan.

- Design a framework for a crypto exchange platform.

- Get ready for cryptocurrency exchange software development.

- Choose a region to start a Bitcoin exchange business.

- Secure a crypto exchange license to operate.

- Set up an office that requires hardware and software.

- Find suitable marketing strategies and grow the business.

These are the steps you need to start a crypto exchange business, now let’s explore them further to understand better.

Here is the step-by-step guide from market research to marketing strategies:

#1. Conduct Market Research

Do thorough market research and analyze the current trends, know when next bitcoin halving, in the crypto market. Analyze existing crypto exchanges, their business model, offerings, features, trade volume, and user feedback.

This will help know what type of trading platform you should build, your audience expectations, and your competitors.

Decide What You Are: Centralized or Decentralized

Before starting your journey as a cryptocurrency exchange business, the first important decision on what you are first. Decide on whether your platform will be centralized or decentralized.

Centralized Exchange (CEX) act as intermediaries between traders and are easy to use but often at the expense of control and security.

Decentralized Exchange (DEX) allows users to trade directly from their wallets, offering more control and privacy but can be complicated to set up.

Tips: Just log into CEX like Binance and DEX like PankcakeSwap and take a glance. Evaluate the pros and cons of each type and choose the one that best suits your business venture. And start doing further research on their features and offerings.

Know Your Competitors

To stand out and find success, you must thoroughly research and understand your competitors first. Know their business model, strengths, weaknesses, and user feedback. Identify gaps in the market and opportunities to differentiate your exchange among the crypto users.

By knowing your competitors, you can better position your exchange and offer the right thing that addresses users’ pain points.

Validate Your Business Idea

Once you’ve decided on the nature of your exchange, it’s time to validate your business idea. Analyze the market and understand the demand for your exchange and its offering (value proposition).

Identify your target audience, and gather feedback from them and stakeholders to refine your idea. Validation will help you determine if your business idea is viable and where adjustments may be needed.

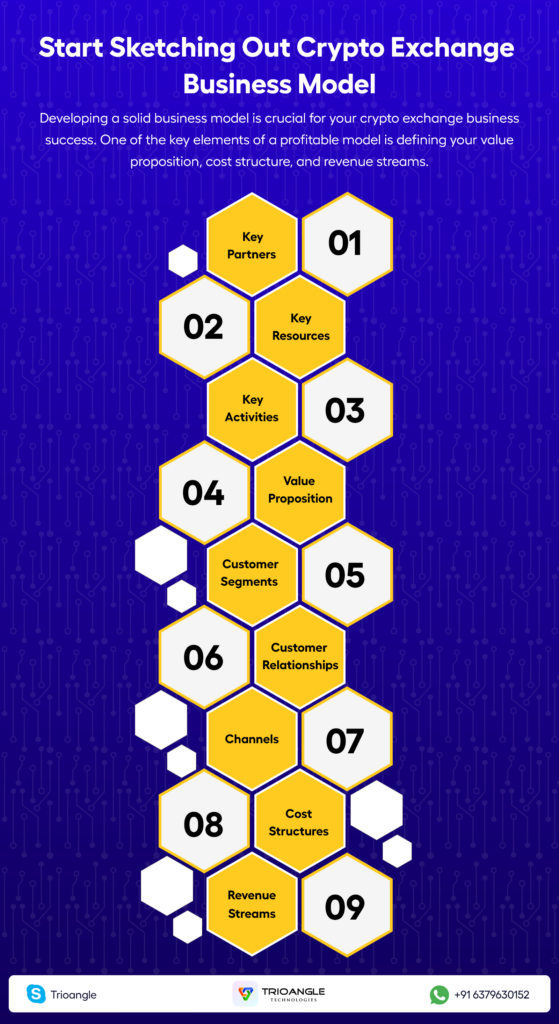

#2. Start Sketching Out Crypto Exchange Business Model

Developing a solid business model is crucial for your crypto exchange business success. One of the key elements of a profitable model is defining your value proposition, cost structure, and revenue streams.

Key Partners – Collaborate with payment processors, banks, legal regulators, liquidity providers, and a reputable cryptocurrency exchange development company.

Resources – Acquire advanced technology infrastructure, blockchain expertise, staff, licenses, and hardware.

Key Activities – Facilitate trades, ensure liquidity, store cryptocurrencies securely, list new cryptocurrencies, and continuously improve platform performance.

Value Proposition – Clearly define the unique offerings and benefits your cryptocurrency exchange platform provides to customer segments.

Customer Segments – Identify and segment your target customers based on factors like trading experience, preferences, and geographic location.

Customer Relationships – Build strong customer relationships through responsive customer support, educational resources, and feedback channels.

Channels – Reach your audience via online ads, social media, email campaigns, phone outreach, blogs, community forums, and websites/ mobile apps.

Cost Structures – Allocate budgets for platform development and maintenance, IT infrastructure, license, secure data centers, salaries, and insurance.

Revenue Streams – Define your pricing strategy and charge fees for transactions, listing new cryptocurrencies, margin trading, subscription, VIP level services, etc.

#3. Design an Architecture for Your Crypto Exchange Platform

To provide a clear overview, it is recommended to create a prototype that visualizes its various components and interactions. This prototype should contain a detailed layout of the site’s user interface, highlighting key features and functionality.

Architecture should explain the blockchain interactions and the platform’s front-end and back-end operations. Additionally, the prototype should provide a super clear understanding of the relationship between each system component.

Here are some details on the features and integration you should have in your crypto exchange software:

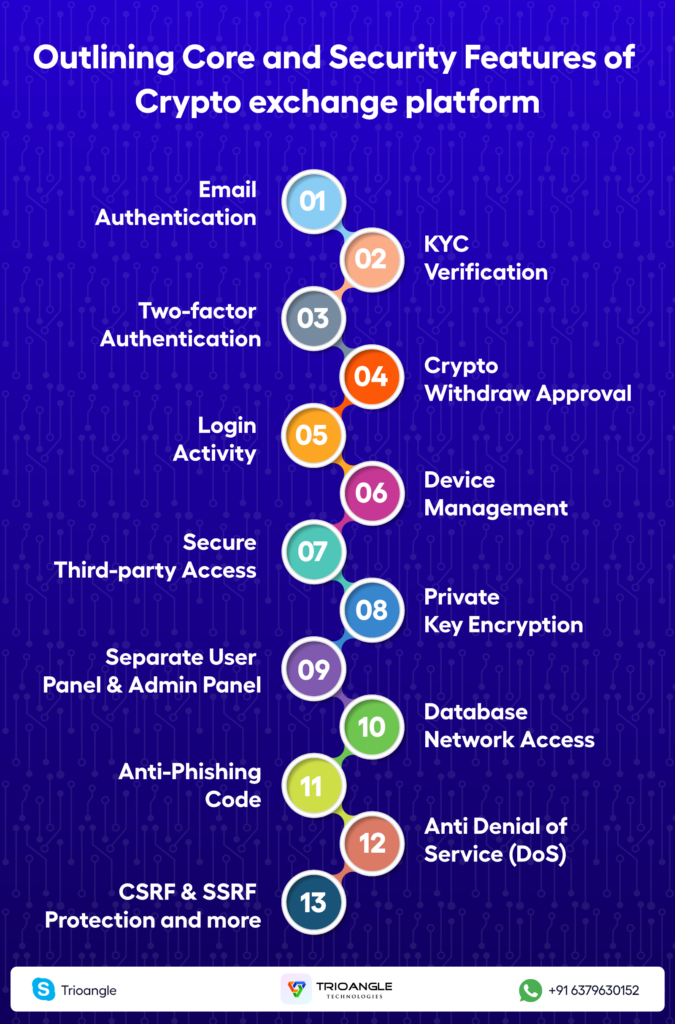

Outlining Core and Security Features

To ensure that trading software is user-friendly, it should have several basic to essential features. These include a secure login mechanism, separate admin and user dashboard, built-in wallet, trade matching engine, and multiple currency pairings.

In addition to these features, other vital components include a referral program, management of trade pairs, onramp/offramp, an order book system, charts, multi-language support, and customer support.

Advanced features like margin, derivatives trading, IEO launchpad, advanced charting tools, and algo trading. These features may seem appealing, but they may add unnecessary complexity and cost to the software.

To create a user-friendly trading platform, it is crucial to prioritize and list the features that your software should include. By doing so, users can have an optimal trading experience.

Also, in cryptocurrency exchange development with bulletproof security, it is necessary to have various security features as per requirement. Some of the following security measures may be included when developing your software:

- Email Authentication

- KYC Verification

- Two-factor Authentication

- Crypto Withdraw Approval

- Login Activity

- Device Management

- Secure Third-party Access

- Private Key Encryption

- Separate User Panel & Admin Panel

- Database Network Access

- Anti-Phishing Code

- Anti Denial of Service (DoS)

- CSRF & SSRF Protection and more

Apart from this, gathering feedback from users or researching popular exchanges like Binance and Coinbase is important. By doing so, you can determine the features and security measures needed to implement.

List the software Integration You Must Have

When it comes to software integration, there are several aspects that one needs to consider. To make the integration process simpler, it’s essential to be aware of the popular options that are most commonly used.

API Integrations: Services such as Binance Liquidity API, TradingView Chart, reCAPTCHA, CryptoCompare, and others if required.

Data Management: Centralized platform MongoDB databases are mostly used and for decentralized platforms blockchains like Ethereum, BSC, and TRON are used.

Wallet Integration: CEX often comes with built-in wallets or options to connect other wallets and for DEX web3 wallets are used.

Payment Gateway Integration: PayPal, cards, wallets, and bank transfers or integrate various other payment methods of your choice.

#4. Prepare for Cryptocurrency Exchange Software Development

After outlining the necessary features and integrations, the next step is to choose the appropriate technical stacks. This is a complex task that requires the assistance of experts from the cryptocurrency exchange development company you choose.

Selecting the appropriate technology stack is crucial, as it differs for developing CEX and DEX software. Also, your project’s scalability, security, speed, and compatibility should be taken into account when making this decision.

For example, here are some popular choices are developing CEX software:

Frontend Development: AngularJS & Node JS, jQuery, Bootstrap

Backend Development: NodeJS, PHP, Python

MEAN stack: Node JS, Angular JS, Express JS

Android App: Flutter, Java

iOS App: Flutter, Swift, iOS Fabric, Objective-C

Databases: Redis, MongoDB, MySQL

Cloud: AWS, Google Cloud Platform, Microsoft Azure

These tech stacks also apply to a white label or cryptocurrency exchange script you buy from a solution provider. However, opting for a development approach will give your crypto exchange a unique advantage over competitors. As it will be designed from the ground up according to your specific ideas and requirements.

#5. Choose the Region for Crypto Exchange Business

Many countries have favorable regulatory environments for crypto trading businesses that allow the usage of stablecoins. These include Austria, Bahamas, Denmark, Estonia, Finland, France, Germany, Gibraltar, Greece, Hungary, Ireland, Italy, Japan, Latvia, Lithuania and Luxembourg.

In addition, Malta, Poland, Portugal, Slovakia, Spain, Sweden, and Switzerland join the list, according to PwC’s report 2024. These countries have legalized and regulated crypto trading activities, making it easier for businesses to operate within their borders.

Some countries like the US, Australia, UAE, and England are still in process of implementing crypto-related laws and regulatory frameworks. Despite this, they show a positive attitude towards crypto exchange businesses by establishing registering and licensing procedures and travel rules.

Therefore, knowing the country’s regulatory framework, Anti-Money Laundering (AML), Counter-Terrorist Financing (CTF), and travel rules is more crucial. This will be useful in designing your crypto exchange business model and determining a suitable region for your business.

#6. Secure the Crypto Exchange License

A Crypto Exchange License is an official authorization granted by a regulatory body in a country that permits a business to operate a cryptocurrency exchange. The process of obtaining a license may vary depending on the country, as each has its regulatory bodies and procedures.

Generally, the licensing process involves submitting documentation of the company’s financial statements, policies for AML/CTF, and insurance policies. Local requirements must also be met if necessary. Once this is done, inspection papers are prepared and submitted along with the licensing application.

Your application will then be forward to the local regulatory body for approval. In some jurisdictions, an interview with the regulator may be require before license approval.

Assuming everything goes smoothly, your crypto exchange license is granted. Your business operations must commence within a specified time frame to maintain the license.

For example, a crypto license is require in the US,

- Renew your license every two years once.

- Provide a list of details of employees.

- Report transactions over $10,000, and more.

#7. Setting Up an Office for Your Business

When setting up an office, there are a few key factors to consider to ensure you’re position against the competition.

First, it is important to choose an office location that is accessible, the right size, and rental fees. Having a physical office space adds credibility to your crypto exchange business.

Second, it’s essential to recruit a team of skilled professionals to handle various aspects of your business. Such as customer support, technology development, legal compliance, and marketing.

Finally, investing in hardware and software is crucial to managing, automating, and running your exchange platform efficiently. Also, implementing strong cyber security measures to protect user data and funds is more important.

By taking these steps, you’ll be on the right track to making your race closer to your competitors.

#8. Tell the World

After your cryptocurrency exchange business is up and running, you need to tell the world i.e. promoting it. Implementing a sound marketing strategy will help increase traffic in the short term and contribute to long-term growth. Therefore, it’s crucial to invest in marketing to ensure your business gets the attention it deserves.

Here are several ways you can promote your cryptocurrency business:

Use press releases to announce your value proposition and step into the race.

Identify customer segments of your business and understand their needs and preferences.

Make use of social media platforms like Twitter, Facebook, YouTube, Reddit, Instagram, etc. Share engaging content like trading tutorials industry news, etc.

Online advertising like Google Ads, YouTube Ads, Instagram Ads, and Facebook Ads.

Enable Referral programs for your platform users to introduce newbies for you to gain loyal customers.

Collaborate with influencers through sponsored posts, partnerships, and exclusive airdrops on your platform.

Content marketing to create a blog or resource center to educate and inspire newcomers.

Using these techniques will help you effectively promote your cryptocurrency exchange business and the services you offer. A successful marketing campaign often involves using several tactics simultaneously. Besides, experiment with different methods and find the ones that work best for your business.

Remember that this market is constantly evolving and expanding, so it’s important to keep up with the latest developments, user feedback, and trends to stay competitive.

Now it’s time to wrap up with a few words…

Final Words

Starting a crypto exchange business can be a challenging and time-consuming process that involves thorough research, planning, development, testing, pre-launch, and finally launching the platform.

Fortunately, by adhering to the steps listed above, you can gain valuable insights into how to start a crypto exchange business in 2024. And be sure you SUBSCRIBE for future updates on this blog to keep up with trends.

If you feel like you’re just scratching the surface, reach out to Trioangle Technologies for support and guidance anytime. Our dedicated team provides support online and helps enliven your crypto exchange.