Explore how to launch a crypto exchange like CoinDCX with exemplary features and a CoinDCX clone app within 30 days.

The cryptocurrency space is maturing, but it’s also expanding with opportunities. So far, CEXs are standing as the prime model in terms of trading volume, liquidity, user count, and trust. Over 200 crypto exchanges are processing trillions in trading volume daily as of 2025.

Creating a full-featured exchange from scratch could take many months and cost hundreds of thousands. Instead, using a CoinDCX clone script offers you a promising edge in the crypto market with pre-built modules and security protocols. With the right partner on your side, you can start your own exchange with a fraction of the cost and a path to high revenue.

In this blog, I’ll break down

- Why launching a crypto exchange like CoinDCX makes strategic sense now

- The modules & features your clone must have

- How to build it rapidly

- A comparison of the top CoinDCX clone software with cost

- Choosing the best CoinDCX clone development company in 2025

Why Start a Crypto Exchange like CoinDCX?

Let’s begin with the why you need to develop a CoinDCX like exchange.

1. A booming market, still early

- The global cryptocurrency market cap in 2025 hovers around $3.4‑4.2 trillion (some forecasts push it even higher).

- Monthly trading volumes across exchanges routinely cross $2–3 trillion+.

- Analysts project the crypto exchange platform market to grow at a CAGR of ~24% over the coming years.

- In many geographies, exchanges are still underdeveloped. Regions in Asia, Africa, Latin America, and parts of Eastern Europe are growth frontiers.

2. Recurring revenue streams

An exchange isn’t a one‑time business. Once live, you can generate recurring, often high-margin revenue from

- Trading fees

- Listing fees

- Withdrawal & deposit fees

- Staking charges

- API access

3. Branding and differentiation opportunity

Using a clone approach gives you core functionality in hand, where you can layer unique features, niche verticals. You can add your idea and also make it sync with your brand to highlight yours as the perfect one in the market.

4. Regulatory Compliance

By structuring properly (KYC/AML, licensing compliance), you can serve jurisdictions whose incumbent exchanges are slow, expensive, or noncompliant. The timing is quintessential. Being first into a market often gives you durable advantages.

So yes! Starting a crypto exchange like CoinDCX is risky, but deeply promising. And doing it fast is a competitive edge.

CoinDCX Clone Features and Modules

If you want to launch a Crypto Exchange like CoinDCX, your clone needs to include core modules and features. Let’s break them down. You should aim for a modular architecture so future upgrades are easier.

- User Onboarding (KYC / AML) – For identity verification

- Wallet Management – Deposit/withdrawal and transaction history

- Trading Engine – Order matching, order types (market, limit, stop)

- Liquidity Management – Ensuring depth and smooth trading with market making bot

- UI / UX – Responsive design for the user panel, admin panel for management

- Mobile App (Android / iOS) | Many users trade via mobile | Real‑time updates, push alerts, charting tools

- API / Integration Layer | For growth & partnerships | REST / WebSocket APIs, coindcx api integration |

- Security & Risk Management – Anti-phishing, DDoS protection, SSL, audit logs, role-based access

- Notification & Alerts – Push alerts for orders, deposits, withdrawals, and price alerts

- Admin Tools – User management, KYC dashboard, transaction monitoring, fee management

- Reporting & Analytics – Trading volume metrics, user growth, revenue reports

- Token Listing & Management – For adding new coins and tokens, delisting

It’s also smart to layer advanced modules after generating consistent revenue.

- Margin/derivatives trading

- Lending/staking/yield farming

- Automated trading bots & AI features

- Decentralized exchange (DEX) bridging

- Liquidity pools & AMM features

The more extensible your architecture, the easier your cryptocurrency exchange like CoinDCX expands in the future.

How to Build a Crypto Exchange like CoinDCX?

How do you actually get to build a cryptocurrency exchange like CoinDCX in about a month? Here’s a step‑by‑step roadmap & best practices in 9 easy steps.

#1 Choosing the right white label CoinDCX clone script provider

- Look for providers with a strong security track record and modular architecture. And also API support, CoinDCX clone app support.

- Ask for demos, security audits, and references

- The right script accelerates your build by 60–70% (some industry reports suggest white‑label scripts reduce development time dramatically).

#2 Defining your niche

Don’t try to compete globally immediately. Pick a market where you have regulatory insight, where incumbents are weak, or where demand is rising. This helps you choose which coins to list, which fiat rails, and the required compliance.

#3 Setting up infrastructure & hosting

- Use reliable cloud infrastructure (AWS, Google Cloud, Azure, or specialized blockchain hosting)

- Separate layers (front end, backend, database, wallet servers, matching engine)

#4 Customize branding, UI, and modules

- Apply your brand, logo, and color scheme

- Integrate UI/UX customizations

- Activate only features you need initially spot trading, wallet, basic KYC)

- If you want, then add advanced features like derivatives, bots, and so on.

#5 Integrating payment gateways and fiat on/off ramps

This often is one of the trickiest parts of getting banking relationships or payment service provider (PSP) support. You may need local banking partners, compliance approvals. Do this as early as possible.

#6 Giving instant liquidity with market making bots

Until you have real users, your order book will be empty. Use crypto market making software or external liquidity providers to seed liquidity. If your clone provider supports external exchange aggregation, enable it.

#7 Testing, audits & security

- Perform rigorous testing to spot vulnerabilities. Fix them accordingly.

- Deploy to a staging environment, test deposit/withdraw flows, trading, and failure recovery

#8 Perform Beta Testing

- Invite a small group of early adopters, like real-time investors and traders, to perform trades.

- Collect their feedback and fix the bugs, if any.

#9 Public launch & marketing

- Announce your crypto exchange like CoinDCX.

- Use digital marketing, influencer partnerships, content (blogs, videos), and referral incentives.

If you follow the above steps rigorously and use a robust clone script, hitting a functional MVP within ~4 weeks is possible.

Well, you may think that Binance is always celebrated in the crypto market. On what basis should I opt for the CoinDCX clone rather than the Binance clone? Come on, let’s compare what’s best.

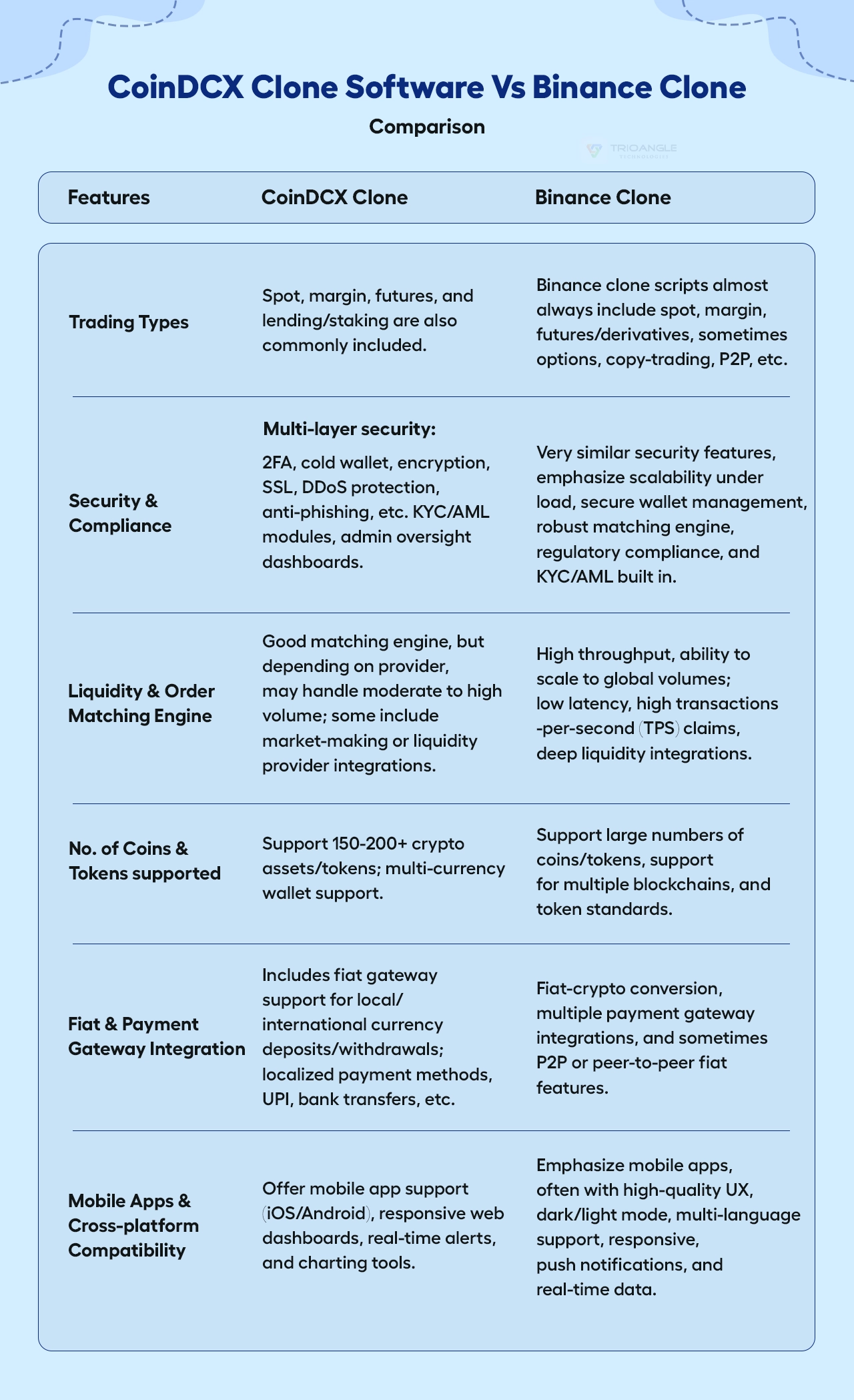

CoinDCX Clone Software Vs Binance Clone: Comparison

The best part here is that both are well-structured to resonate with the upcoming crypto market trends. But to get a clear understanding, let’s compare the CoinDCX clone with the Binance clone with their key features.

CoinDCX is an exchange focused largely on markets like India and nearby regions. Emphasizing spot, margin, derivatives/trading, regulatory compliance (KYC/AML), localized fiat ramps, also staking, lending, etc.

Binance is one of the world’s largest exchanges with massive liquidity, many trading pairs, and advanced derivatives. With the global reach, a huge user base, advanced features like Binance Smart Chain/DeFi integrations, large ecosystem.

What is the CoinDCX Clone Development Cost?

Cost ultimately depends on how much you want to customize, your region, how many modules you include, and how robust your security needs are. The cost estimation broadens when you integrate essential and advanced features into it.

Here is a rough breakdown and ranges in 2025 (USD).

- Set up & Customization – $2,000 – $5,000

- Mobile apps(iOS & Android) – $3,000 – $8,000

- KYC/AML Integration – $1,000 – $5,000

- Security Audits – $3,000+

- Payment Gateway Integration – Depends on your niche

If we calculate all of these as a whole, your budget starts at $9,000+. But if you choose the basic model, you’ll get less than the amount specified.

Who is the best CoinDCX Clone Script provider in 2025?

You’ve read about demand, modules, roadmap, costs, and evaluation criteria. The right CoinDCX clone development company can make or break your venture. In that way, Trioangle stands as the best CoinDCX clone script provider in 2025.

With our professionals, you get complete control of your platform and the customization freedom to fine-tune it to your business goals. We prioritize security and perform audits, and built our engine to handle around 15,000 transactions per second without any delay.

With the Binance clone script, you can build any kind of platform to start your platform with basic to advanced features. We give you the first 3 regular services to your crypto exchange like CoinDCX, and free post-launch support for feature integration.