Want to establish a powerful Binance Futures Trading Platform that attracts serious traders and generates regular revenue?

The Binance Futures Trading has changed the derivatives market by combining high leverage, highly liquid cryptocurrency trading with advanced risk management. Establishing a Binance Futures-style platform requires entrepreneurs and exchanges to use perpetual contracts, powerful matching engines, and scalable income structures, while offering a professional trading experience that meets modern market expectations.

What is Binance Futures Trading?

Binance Futures trading is a cryptocurrency derivatives trading system that enables traders to bet on future prices without actually owning them. Instead of buying or selling the digital currency itself, users trade futures contracts that track the asset’s price.

This approach enables traders to profit from both long and short positions, regardless of whether the market is rising or falling. Binance Futures also offers leverage, allowing traders to hold larger positions with minimal capital investment, while built-in risk management measures help to control market volatility.

The Key Features of the Binance Futures Trading Platform

- It offers a higher speed of the trade engine for quick transactions.

- Flexible crypto leverage trading platform options for the binance future trading platform.

- There are two types of contracts, perpetual and quarterly contracts.

- Two types of contracts Cross and isolated margin trading futures.

- Various order times available, such as market, limit, and stop orders.

- Funding rates for the perpetual contracts.

- Real-time liquidation and risk management system.

- Secure wallets and a fund management system.

- Supports various of cryptocurrencies and collaterals.

- Chart and analytics management system.

- It offers an API for automated and algorithmic trading.

- Ensures deep liquidity and high trading volume support.

Types of contracts in Binance futures trading

Binance Futures primarily provides two contract types for trading changes in cryptocurrency prices.

USDT Margined Futures

These contracts employ USDT for margin and settlement.

- You trade with USDT.

- Profits and losses are calculated in USDT.

- Easier to understand and control risk

- Ideal for novices and short-term traders.

COIN Margined Futures

- These contracts make use of the cryptocurrency itself, like BTC, ETH, etc.

- You trade using cryptocurrency as margin.

- Profits and losses are in cryptocurrency.

- Ideal for hedging long-term assets.

- Increased risk due to cryptocurrency price fluctuations.

Core components of Binance futures trading

Matching Engine

Matches buy and sell orders instantly, ensuring quick and accurate futures trading.

Order Management System

Users can make, change, and cancel orders, including market and limit orders.

Margin and Leverage System

Manages user margins, leverage levels, and position sizes in Binance Futures trading.

Wallet Management

Safely manages user funds, margin balances, and settlement.

Liquidation System

Automatically closes dangerous bets to prevent losses exceeding the available margin.

Risk Management Module

Monitors market volatility and trade activity to ensure platform stability.

Security Framework

The Encrypts payments and data with cold wallets and access controls.

Admin Dashboard

Allows platform owners to monitor trades, users, and system performance in real time.

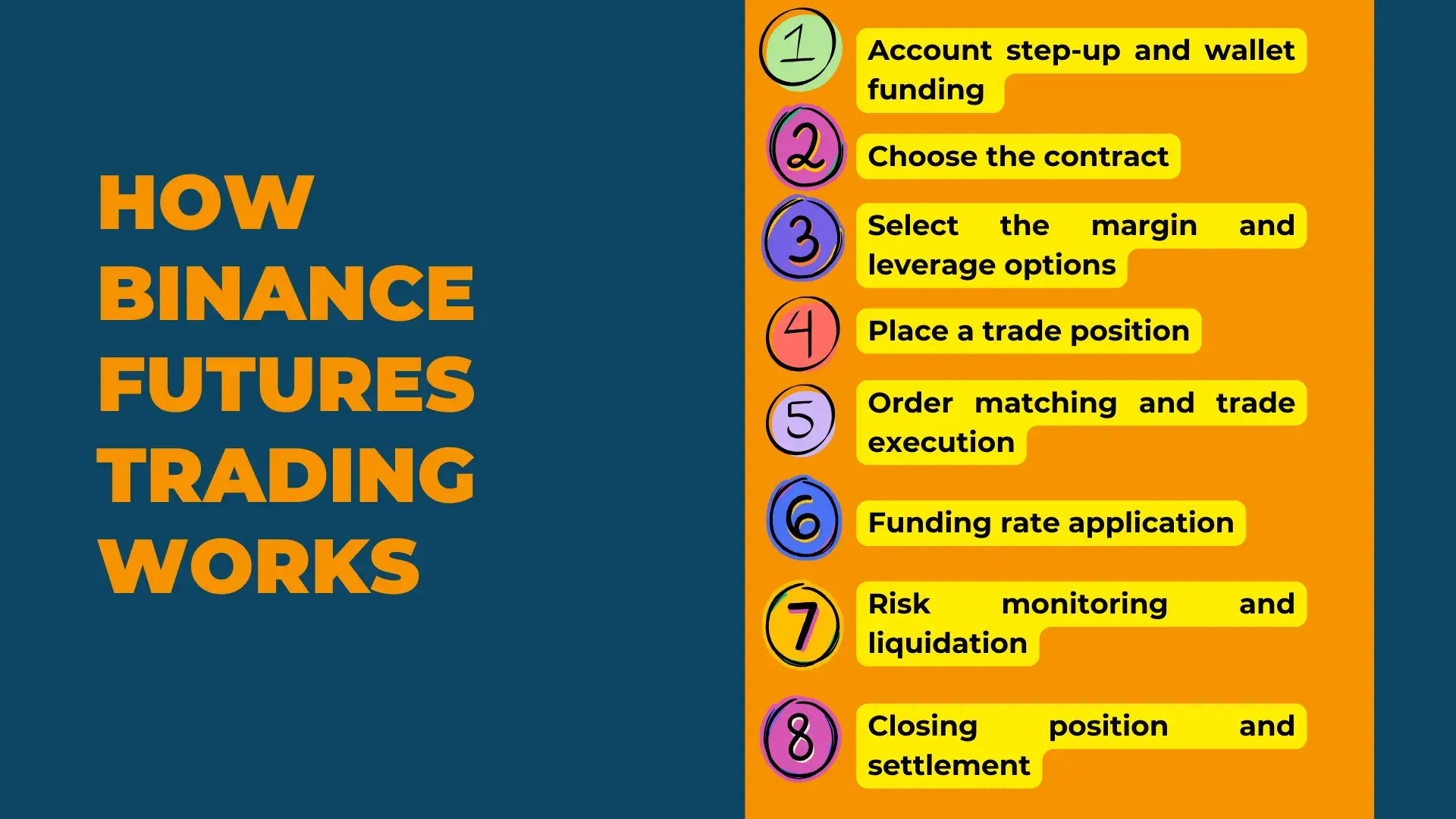

How Binance Futures Trading Works

The following are step-by-step working processes that the binance future trading works perfectly inside the crypto exchange platform. Let’s go through it!

Account step-up and wallet funding

- The user wants to create an account on the binance future trading platform and transfer their funds to their wallet.

- The collateral is always held in USDT with some supported cryptocurrencies.

Choose the contract

- The traders can choose the future contract, such as USDT- margin or coin-margin contracts.

- This depends on the trading techniques and settlement preferences.

Select the margin and leverage options

- As the traders, you can select the cross margin or isolated margin with the leverage options, which will determine the required risk and margin.

Place a trade position

- There are various options available, like market rice, limit, or stop orders.

- If the traders wants to long position means they expect the price to go high

- If traders want to take short positions, they expect prices to fall.

Order matching and trade execution

- After that, the order matching engine will match the buyer and seller orders in real-time.

- This will ensure faster trading execution with minimal slippage.

Funding rate application

- The periodic funding fees are exchanged between the longer and shorter traders.

- This keeps the futures prices aligned with the spot markets.

Risk monitoring and liquidation

- The system regularly checks margin ratios. If margins fall below the maintenance threshold, liquidation measures are activated to protect losses.

Closing position and settlement

- The Dealers close positions manually or with automated triggers.

- Profits and losses are transferred quickly to the futures wallet.

Security measures in the Binance futures trading

- Two-factor authentication

- Anti-phishing code

- Withdrawal whitelisting

- Cold wallet storage

- End-to-end encryption

- KYC/AML protocol

Revenue streams of the Binance Futures trading platform

The Binance futures trading earns revenue streams in various trading and platform-related charges. These revenue streams grow as trading activity increases.

Trading Fees

This is earned from maker and taker fees applied to each futures trade conducted by users.

Funding Fees Impact

Funding payments are made between traders, resulting in more trading activity and, consequently, higher platform fee revenue.

Liquidation Fees

Collected when positions are forced to close due to a lack of margin during volatile market circumstances.

Withdrawal Fees

Users are charged for using the blockchain network when they withdraw digital assets from the futures platform.

High-volume trading activity

The high volume will be created by frequent trades, experts, and bots that create steady fee-based revenue on the site.

Cross-Market Trading Usage

Users who trade in spot, margin, and futures markets enhance total transactions and overall platform revenue.

Benefits of Building a Binance Futures Trading Platform

Creating a Binance futures trading platform supports the business to enter the crypto futures markets and easily attract both traders. The advantages are,

High trading volume

Futures trading typically has more trading activity, allowing platforms to make consistent revenue.

Multiple income sources

Platform owners can profit from trading fees, funding fees, liquidation costs, and premium services.

Attracts professional traders

Both experienced and institutional traders like advanced features, charts, and order types.

Leverage Trading Options

Futures trading enables users to trade with leverage trading options, which boosts user interest and platform engagement.

Strong Risk Control Features

Built-in features such as margin management and liquidation safeguard both traders and the platform.

Scalable business model

This future trading platform will easily give access to more users, such as trading pairs, and the global market.

Why Choose a Binance Futures Trading Platform Development

The Binance futures trading platform development company, which helps to create a futures trading platform quickly and safely. Instead of developing everything from scratch, you can get a pre-built system with the business proven model. These companies include built-in capabilities such as order matching, leverage control, liquidation management, and tracking of risks, which are required for futures trading.

They also prioritize robust security, such as wallet protection, user identification, and fund safety methods. Another benefit is scalability. The platform can handle high trading volumes and future development without compromising performance. Most significantly, you receive customization and compliance help, making it easy to tailor the platform to your specific needs and area standards.

Final takeaway!

In summary, a Binance Futures Trading Platform Development Company is likely, as a Binance clone script platform allows businesses to establish a safe, scalable, and powerful Platform. The Binance Futures Trading solutions enable organizations to enter the derivatives market more quickly while assuring dependability, compliance, and steady expansion in the dynamic Binance Futures ecosystem.