You intend to create a cryptocurrency exchange, and how are trades matched in real-time? That magic occurs through a powerful engine that connects buyers and sellers in seconds. The cryptocurrency industry moves quickly, and real-time order matching is the fuel that drives trade. The order matching engine (OME) is the fundamental component of any cryptocurrency exchange, either white-labeled or built from scratch. It matches trade orders, controls price fluctuation, and provides a smooth trading experience. Matching is an important feature in white label crypto exchange platforms. If you intend to build one. Let us discuss it below.

What is a Real-Time Order Matching Engine?

Real-time order matching is a crucial component of trade execution on the exchange platform. This can match buyer and seller orders in real-time machines. These can be operated on using an algorithm, such as,

- Price-Time Priority (FIFO)

- Pro-Rata Allocation

- Queue-based Matching

Without a doubt, the engine ensures that deals are conducted fairly and effectively. It works similarly to a computerized auctioneer, instantly pairing and executing compatible orders.

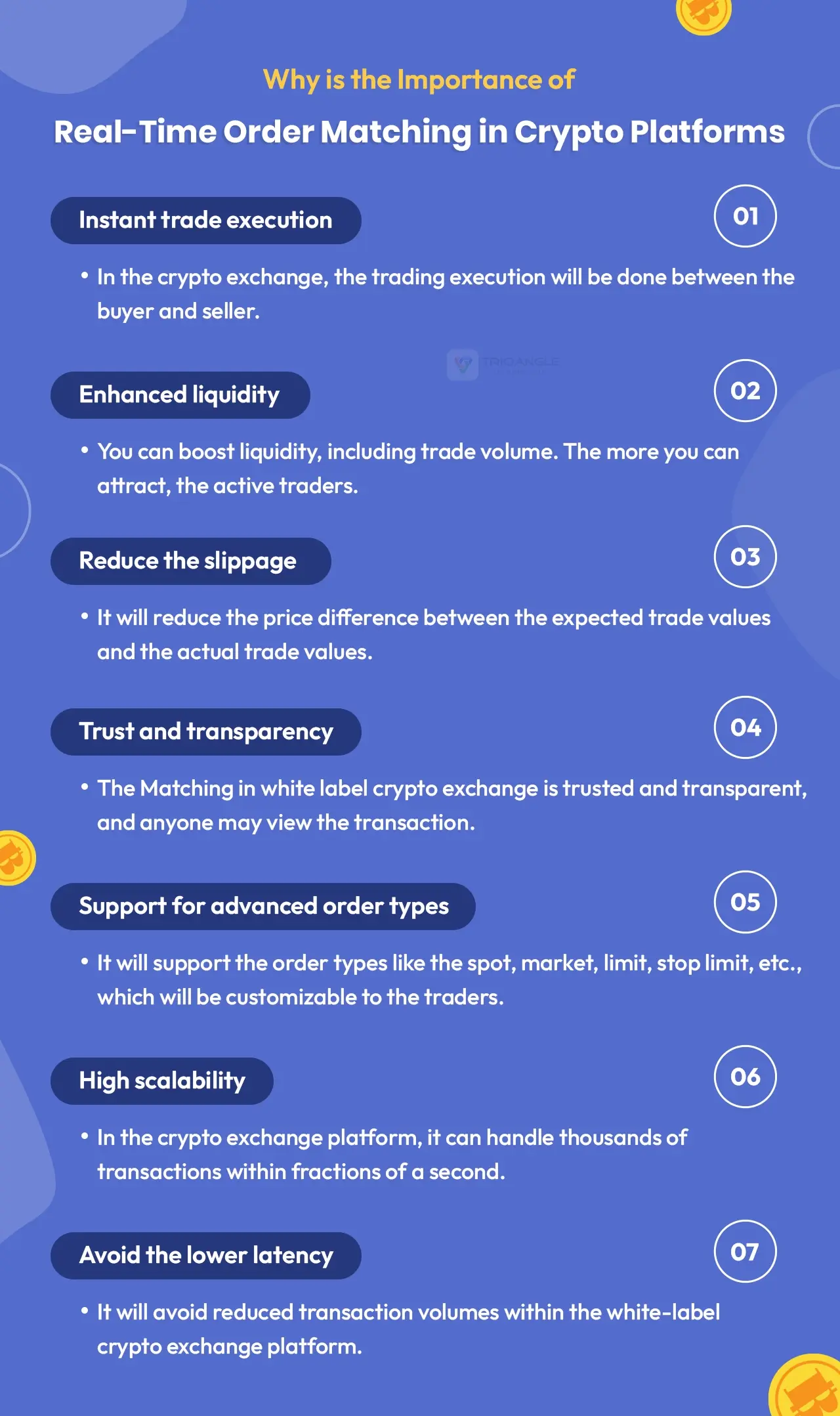

Why is the Importance of Real-Time Order Matching in Crypto Platforms

The milliseconds can make or break a cryptocurrency trade. Here’s why real-time matching in white label cryptocurrency trading platforms is essential are,

Instant trade execution

In the crypto exchange, the trading execution occurs between the buyer and seller. Without any delay, satisfy all transactions.

Enhanced liquidity

You can boost liquidity with trade volume. The more you can attract, the active traders.

Reduce the slippage

It will reduce the price difference between the expected trade values and the actual trade values.

Trust and transparency

The Matching in white label crypto exchange is a trusted and transparent platform. On the blockchain platform, anyone may view the transaction.

Support for advanced order types

It will support the order types like the spot, market, limit, stop limit, etc., which will be customizable to the traders.

High scalability

In the crypto exchange platform, it can handle thousands of transactions within fractions of a second.

Avoid the lower latency

It will avoid reduced transaction volumes within the white label crypto exchange platform.

How Orders Are Classified in an Order Matching System

Spot order

- A spot order is used for the immediate execution at the currency market price.

- It allows real-time asset transfer with instant settlement.

- After that, The spot order is the common and is used for buy and sell orders.

Market order

- Market orders will be fulfilled at the best available prices.

- The priorities are speed over accuracy price.

- Ideal for quick entrance and exit, but may have slippage in violent markets.

Stop order

- The stop order becomes like a market order.

- Once the stop price is reached, the trading pairs will be executed.

- Also, they are designed to limit losses or secure a profit.

- The stop order is also used as a risk management tool.

Limit order

- The limit order ranks as one of the most secure orders on the market.

- Only executes at the stated or better price.

- The market remains open until the set price requirement is met.

- Allows for complete pricing control, but may go unfulfilled.

Stop-limit order

- The stop-limit order combines stop and limit commands to improve precision.

- When the stop price is reached, the limit order is exchanged with a market order.

- It is useful for managing execution conditions, but it also carries non-execution risk.

Trailing stop order

- A moving stop order that adjusts to market movements.

- Profits are locked in while deals stay open during positive trends.

- Automatically changes the stop price in response to asset movement.

Popular Matching Algorithms Used in Crypto Platforms

When it involves matching in a white label crypto Exchange platform, in fact, the algorithm used has a direct impact on trade effectiveness, equality, and platform confidence. The following are the most commonly used ones are,

Price time Priority (FIFO)

- Orders are matched based on the best price, and if multiple orders have the same price, the most recent order is matched first.

- For Example, if User A and User B both place $30,000 buy orders, but User A’s order is filled first because it was placed 2 seconds earlier.

Pro-rate matching

- In Pro-Rate Matching, the system distributes trading volume proportionally among all those who placed orders at the best price.

- This means that if numerous buy or sell orders are submitted at the same price, every player receives a piece of the trade proportional to the size of their order.

Queue-based matching

- The Queue-based matching means that the heading itself has the meaning.

- As the name implies, Queue-Based Matching processes requests in the exact order they are received.

- It does not emphasize size or speed, but rather the order’s time of arrival in the queue.

- This approach is based on a guaranteed business model and predictability.

Randomized matching

- In Randomized trial Matching, the engine chooses orders at random from those that are eligible at the same price level.

- This approach is used to avoid front-running, abuse, or favoritism on decentralized or peer-based platforms.

Custom Hybrid model

- The hybrid model is based on both the Price time priority and Pro-rate matching.

- To provide greater flexibility and accommodate different trading pairings or product categories.

- This method enables the exchange to conduct various trading markets with distinct matching algorithms under one roof.

Step-by-Step Integration Process

Matching in White Label Crypto Exchange is an important part of the trade execution. Let us look at the step-by-step approach for integrating trade matching.

Choosing a Compatible White Label Framework

- Before adding a matching engine, you’ll need a modular white label exchange structure that accepts plugins from third parties.

- The framework should support real-time communication across the front end, backend, and order matching engine.

Selecting the Right Matching Engine

- Your next step is to select a high-speed, low-latency matching engine that is appropriate for your trading model, such as spot margin futures, etc.

- Similarly, Engines can be developed in Rust, Go, or C++ for maximum performance.

- Choose between self-hosted and third-party engines that allow for custom matching logic in white label crypto exchange setups.

Integrating via APIs and Protocols

Secure APIs enable you to connect the matching engine to your exchange backend.

- Use REST APIs to place and cancel orders.

- Use WebSockets for real-time trade updates and the FIX protocol for institutional connections.

The Well-integrated APIs provide easy matching in white label crypto exchange systems with real-time responsiveness.

Order Book Synchronization

The order book links user orders to the matching engine.

- Ensure that your backend promptly syncs with the engine for any new, amended, or canceled orders.

- For real-time syncing, consider using Redis or Kafka.

Setting Execution Rules

However, you can define how the traders can execute the transactions when a match is found.

- Set some rules for the order types, like market, limit, stop orders, etc.

- Integrates the slippage tolerances, spread protections, and enables the fee handling system.

Performance Testing & Optimization

Before going live, make sure your system can manage heavy trade volumes.

- Simulate thousands of trades at the same time.

- Conduct latency tests and mimic order floods.

This assures that your platform maintains consistent matching in white label crypto exchange environments, regardless of stress.

Real-time Monitoring Setup

Deploy monitoring tools to track the matching engine’s health and performance.

- Use Grafana, Prometheus, or the ELK Stack.

- Keep track of the number of transactions per second (TPS), latency, and order status errors.

Conclusion

However, A real-time matching engine is at the heart of any high-performance white label crypto exchange development company. Whether you’re building a spot, margin, or futures trade platform, efficient matching in white label crypto exchange systems guarantees lightning-fast execution, increased liquidity, and a smooth user experience.

Your exchange can satisfy the demands of current crypto traders by using the appropriate matching algorithm, a scalable white-label infrastructure, and correct integration with the API and performance testing. With the right setup, you won’t just keep up with the competition, you’ll outperform it.

Empower Your Crypto Exchange with Real-Time Order Matching