Thinking about getting into cryptocurrency trading but unsure where to start? You are not alone. With so many trading possibilities available, it can be overwhelming at first.

However, here’s a great starting point for spot trading. A spot trading crypto exchange allows you to purchase and sell cryptocurrencies quickly at current market values. There’s no waiting. There are no complicated contracts. Just straightforward, real-time trade in which you control the cryptocurrency you purchase.

In this easy-for-beginners guide, we’ll explain how spot trading works, why it’s excellent for beginners, and how you can start your first crypto trade now.

What is a Spot trading crypto exchange?

A spot trading crypto exchange is a platform where you may buy and sell cryptocurrencies with speedy delivery. Simply put, traders acquire cryptocurrency at current market prices, spot prices, and immediately own the commodity.

Spot trading is easier than futures or margin trading. You presently pay for the assistance that you obtain. Consider buying apples at a stand rather than ordering them months in advance, or borrowing them from a friend.

How does spot trading work

Spot trading on a crypto exchange is straightforward and suitable for beginners. Here’s a step-by-step explanation of how it operates.

Choose a spot trading crypto exchange

Choose a reputable, safe crypto trading exchange site that accepts the coins you wish to trade. For more information, you can keep in touch with the top 10 crypto trading strategies on the exchange platform.

Create an account

Create an account and sign up by validating some original identity information.

Deposit the funds

Connect the wallet with your platform. And add the funds to your wallet. Either it’s the fiat or the cryptocurrency.

Select the trading pairs

On the spot trading crypto exchange platform, select the trading pairs that will be displayed on the platform.

Place your orders

Place the orders based on the order types, like

- Limit order

- Market

- Stop limit

- Spot

Trade execution

Once the trade is matched, the trade engine will match pairs on the spot trading crypto exchange platform.

Store or withdraw

You can either hold the cryptocurrencies or withdraw them and store them in a wallet.

By ensuring the security analysis.

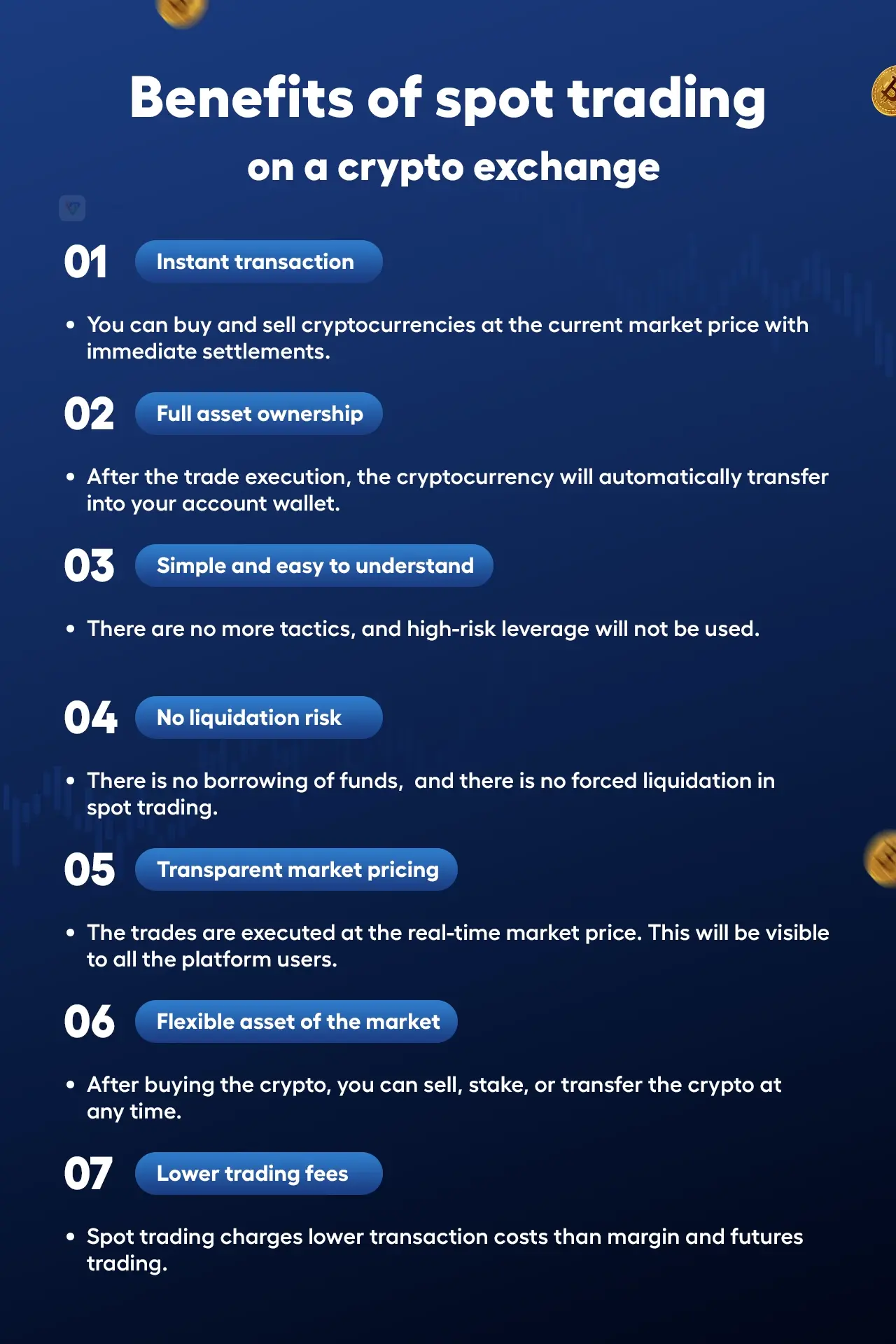

List out the benefits of spot trading on a crypto exchange

- You can buy and sell cryptocurrencies at the current market price with immediate settlements.

- So you cannot wait for a long time, and also there is no future contract.

Full asset ownership

- After the trade execution, the cryptocurrency will automatically transfer into your account wallet. Without any delay or problems.

Simple and easy to understand

- Spot trading on a cryptocurrency exchange is simple for beginners.

- There are no more tactics, and high-risk leverage will not be used.

No liquidation risk

- There is no borrowing of funds, as there is with margin trading.

- As a result, there is no forced liquidation in spot trading.

Transparent market pricing

- The trades are executed at the real-time market price.

- This will be visible to all the platform users.

Flexible asset of the market

- After buying the crypto, you can sell, stake, or transfer the crypto at any time.

- This will be an adaptable asset in the spot market.

Lower trading fees

- Spot trading charges lower transaction costs than margin and futures trading.

If you wish to reap more, then spot margin vs futures trading is what you need to understand. Margin and futures trading also carry more benefits with leverage options and a cooling-off period, too.

Popular cryptocurrencies in the Spot trading crypto exchange

Spot trading on crypto exchanges allows you to trade a wide range of digital currencies quickly. There are thousands of cryptocurrencies, but only a few dominate the spot trading landscape due to their high availability, market trust, and large user base. The following are some of the most widely traded currencies on spot exchanges:

Bitcoin

- Bitcoin is the most widely used and accepted currency in the world.

- It is frequently the first coin purchased and a popular basis for trading pairs such as BTC/USDT.

- Spot traders prefer it due to its high liquidity and regular presence.

Ethereum

- Ethereum, the second most valuable cryptocurrency by market value, is extremely popular on spot markets.

- With numerous DeFi and NFT projects built on its blockchain technology.

- Ethereum is routinely traded against USDT, BTC, and other tokens.

Tether

- USDT is a stablecoin that is linked to the US dollar and is commonly used as the base currency in the spot market.

- Most cryptocurrency pairs are displayed against USDT, such as BTC/USDT, making it the most frequently traded in spot trading.

Solono

- Solana is gaining popularity due to its lightning-fast transactions and expanding ecosystem.

- It is readily accessible for spot trading and attracts individuals seeking to invest in next-generation blockchain technology.

Binance coin

- Binance’s native spot exchange frequently uses its cryptocurrency, BNB.

- It has cheaper trading fees and is often associated with large coins.

Ripple

- Despite regulatory obstacles, XRP is a popular choice on spot trading crypto exchanges because of its practical utility and widespread community support.

Cardano

- Cardano is renowned for its scholarly approach and commitment to security and scalability.

- ADA is another popular asset traded on spot marketplaces.

USD coin

- USDC, like USDT, is a popular stablecoin that is frequently used in pairing and chosen by traders seeking openness and compliance with regulations.

If you’re starting or have already delved deeper into trading techniques, understanding these key cryptocurrencies will assist you in making smarter trading selections on a spot crypto exchange.

How to choose the best cryptocurrency spot trading crypto exchange

With the variety of cryptocurrency exchanges to choose from, it can be difficult to find the proper place to trade, especially if you’re just getting started.

Security features

The security features are,

- 2FA

- Anti-phishing code

- DDoS protection

- KYC/AML verification

- End-to-end encryption

- Data protection, etc.

High liquidity

Liquidity indicates that there are sufficient sellers and buyers on the trading platform to complete your trades immediately at reasonable rates.

Low trading fees

The spot trading crypto exchange will reduce the trading fees. Which charges a small amount of fees, like 0.005%.

User-friendly interface

This is very easy to use for beginners, like

- a simple and easy dashboard system with real-time chart management.

- Easy to navigate the platform means.

- There is a mobile app also you can also use.

- Having a clear buyer and seller.

Supported cryptocurrencies

- Supports multiple currencies like BTC, ETH, SOL, USDT, etc.

- Which will be easy for the beginners.

Regulatory compliances

The regulatory compliances like the

- KYC (Know Your Customer) and anti-money laundering (AML) protocols.

- Licenses or permissions from the banking sector.

Choosing the best spot trading crypto exchange is about more than just functionality; it’s about selecting a dependable, safe, and easy-to-use system.

A Simple Guide to Create and Launch a Spot Trading Crypto Exchange Platform

In today’s booming digital economy, creating a spot trading crypto exchange might be a profitable business decision. Here’s a step-by-step guide to setting up your spot trading cryptocurrency exchange.

Market search and search planning

Before you begin, research the cryptocurrency market, your target audience, and what the competition is offering.

Choose the exchange types

You can choose the exchange types like

- Centralized exchange

- Decentralized exchange

- Hybrid exchange

Hire a crypto exchange development company

Develop your platform in partnership with a trained development team. They can help you get started faster with skilled solutions.

Obtain the legal licences

Follow the rules in your country and receive the required licenses. This ensures that your exchange operates legally and safely.

Implement the key features

Include essential features like trading pairings, user dashboards, and rapid buy/sell options. Make the platform simple to use.

Robust for security purposes

Use two-factor authentication, cold wallets, and anti-hacking solutions. A secure platform increases user trust.

Liquidity management

Connect with liquidity providers to ensure smooth and fast trading. It helps to avoid pricing delays and unfilled order books.

Completely test the platform

Assess for defects, measure speed, and assess the user interface. Before you launch, make sure all works correctly.

Launch and promote

Go live and begin selling your platform. Use social networking sites, influencers, and cryptocurrency forums to attract users.

Update and scale the platform

Continue adding additional features and coins. Regular upgrades will help your exchange expand and remain competitive.

Launching a spot trading crypto exchange is no easy endeavor, but with the appropriate team, legal setup, and user-friendly features, you can create a secure, scalable, with Guaranteed business model that provides consistent revenue.

Beginner tips for success in the spot trading crypto exchange

Here are some basic ideas to help you trade more effectively on a spot trading crypto platform.

Understand what you are doing

When you start buying and selling, have an overview of how spot trading operates.

Start small

Don’t invest a large sum initially. While learning, keep your expenses to a minimum.

Use limit orders

Limit orders allow you to choose your price rather than buy at the current price. It provides you with eating control.

Do not trade with emotions

Don’t panic if prices decrease or if the market becomes too hyped. Keep calm and adhere to your plan.

Do your research

Before trading any cryptocurrency, examine the most recent news, prices, and charts.

Learn Basic Charts

Understand simple patterns such as support and resistance to determine whether to purchase or sell.

Losses are normal

You will not win every deal, and that is okay. Learn from your mistakes.

Keep your cryptocurrency safe after

If you do not intend to trade frequently, transfer your coins to a secret wallet after purchase.

Do not put all your money in a single coin

To reduce risk, spread your assets among various cryptocurrencies.

Keep learning

Stay up to date on cryptocurrency news and continue to improve your trading skills.

Final thoughts

Spot trading is one of the simplest and most secure methods to enter the global market of cryptocurrency. With quick transactions, full ownership of assets, and simple trading mechanics, a spot trading crypto exchange is ideal for both novice and expert traders.

By selecting the correct platform, knowing the fundamentals, and implementing smart trading advice, you may confidently begin your crypto journey and capitalize on market possibilities. Partnering with a reputable Cryptocurrency exchange development company can make a significant difference in creating a secure and scalable exchange. Start small, stay updated, and trade wisely!