Have you staked assets in DeFi protocols and are earning rewards currently? If yes, “Congratulations.” You’ve joined the world of passive income. But, while your assets nap politely in a validator contract, other users are making more yields with the same tokens you have used to stake. So, what have you missed? It’s “Restaking”, a new layer of utility built on top of the traditional staking concept.

In this blog, let me explain everything about restaking. We’ll explore the core concepts of restaking, how it works, how you can actually earn, and what risks you should be careful of. By the end, you’ll understand restaking clearly and feel confident.

So, let’s dive in.

What is Restaking?

Restaking is a strategy used by traders to maximize their returns by leveraging staked assets across multiple protocols or layers simultaneously. Instead of unstaking their assets, users allow the same assets to be utilized on other platforms while continuing to earn rewards from the original staking. This enables users to earn rewards from both staking and restaking.

This ”restaking” concept has become popular through platforms like EigenLayer. This platform is built on the Ethereum network and allows users to restake their ETH assets more effectively. Additionally, it enables users to restake various Liquid Staking Tokens (LSTs) like stETH, rETH, and cbETH to help secure other modules or services.

Basically, it’s about expanding the use of your stake beyond its original purpose. As a result, you receive extra rewards for your contribution.

Now, let’s jump into the topic that you have actually come for. Let’s see…

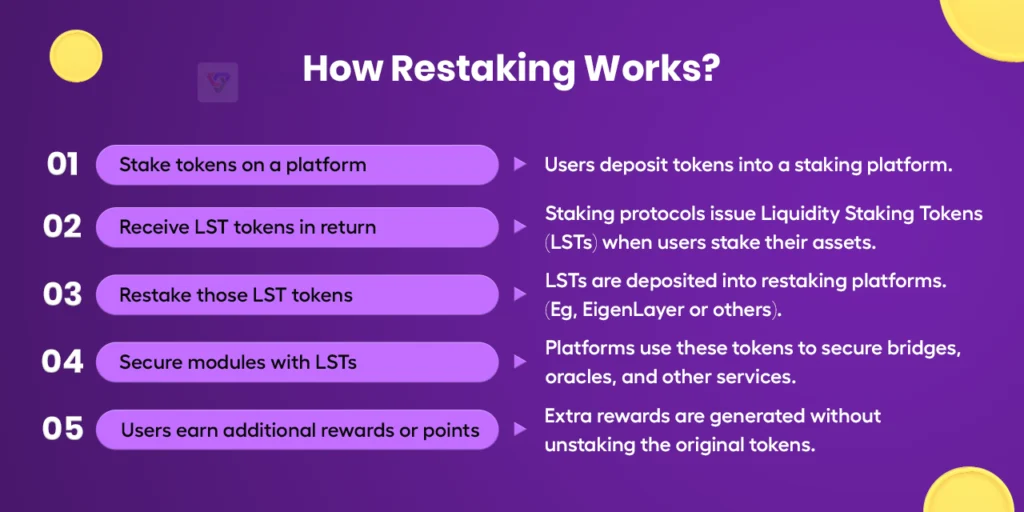

The Working Mechanism of Restaking and (How You Can Earn?)

Here’s the simple breakdown of how restaking works and how it maximizes users’ assets. To help you digest this concept more easily, let me break it down using a clear and simple ETH staking scenario.

- First, users stake their ETH assets inside the liquidity staking platforms like Lido or others. In return for staking their assets, these platforms provide users with liquidity staking tokens (LST), for example, stETH and others.

- Now, users hold liquidity staking tokens such as stETH or others, which still earn staking rewards for them.

- Instead of leaving those LST tokens idle, users can deposit them (Restake) into staking platforms like EigenLayer or others.

- Restaking platforms, such as EigenLayer, utilize your LSTs to secure third-party modules, including bridges, oracles, data availability layers, and other decentralized services.

- For using your LST tokens, the restaking platforms allow users to earn additional points or rewards depending on the modules that the staking protocol supports.

- If the user continues to hold their positions, they can maximize the value of staked assets without unstaking their existing stETH (LST tokens).

So, are you thinking like: “I can earn with the same assets without unstaking them? Sounds simple, but there’s no other benefit, right?”

No, think again. Restaking is not only popular for one reason in the DeFi ecosystem. It presents several benefits. It’s an effective tool for crypto users aiming to increase their returns without engaging in riskier strategies.

So, let me list out…

The Real Benefits Of Restaking

Here’s a summary of the advantages of restaking.

#1 Expanding Use Cases

By restaking your assets, you help to secure multiple parts of the decentralized infrastructure, not just one chain. So, you can participate in the DeFi ecosystem and help it work effectively, while creating passive income.

#2 Compounded Yield

By participating in restaking, you can generate revenue from multiple streams from the same position. For example, you can earn staking rewards from Ethereum while earning points or native rewards from restaking protocols using restaked assets.

#3 Capital Efficiency

Rather than committing new capital for every opportunity, you can maximize the value of the assets you have already staked by using them again. This approach helps you to generate profits without any hassles.

You have explored the benefits you gain by participating in restaking. Now, some of you might think like: “Is there any popular restaking platform existing in the DeFi space, or is only EigenLayer an option to restake my assets?”

The answer is NO. Let’s explore some…

Top Platforms To Maximize Your Assets With Restaking

In today’s 2025 landscape, various platforms are key players in the restaking industry. Each of these platforms offers innovative and different earning opportunities depending on the asset type that the user stakes and the network they prefer.

Here I’ll list out some popular restaking platforms.

#1 EigenLayer

EigenLayer is one of the most popular and actively serving restaking protocols. This platform currently supports the Ethereum network and allows users to restake Ethereum-based liquidity staking tokens (LSTs) like ETH, stETH, and more.

This platform incentivizes users with EIGEN TOKENS (EigenLayer’s native token) and additional rewards for users who participate in restaking activity on this platform.

The EigenLayer currently has $17 billion in TVL of restaking assets. And, this platform continues to partner with a growing number of middleware projects. These include decentralized oracles, data availability layers, and zero-knowledge proof systems. Also, in the future, they are expected to add more functionality for users.

#2 Symbiotic

Symbiotic is a decentralized restaking platform. Unlike other restaking platforms that only support ETH-based tokens, Symbiotic allows its users to restake various ERC-20 tokens and other assets across multiple networks.

This helps to secure services on both Layer 1 and Layer 2 networks. As a result, this offers users greater flexibility, better integration between chains, and access to a wider mix of rewards.

This platform is equipped with more useful features like yield optimization, auto-compounding, and more. This new platform has currently started onboarding its early adopters through points-based incentive campaigns. At the time of writing this blog, the Symbiotic platform now holds approximately $1 billion of TVL.

#3 Karak Protocol

Karak is known as a universal restaking protocol. This platform is especially designed to foster cryptoeconomic security using any asset. Karak permits users to restake a wide range of assets, including Ethereum (ETH), Wrapped Bitcoin (wBTC), stablecoins, and Liquid Staking Tokens (LSTs) across multiple networks (Ethereum, Arbitrum, and its own K2 L2 chain).

This protocol currently stands as the best restaking platform with TVL (Total Value Locked) of approximately $740 million to $1 billion. Karak is ideal for users who want to experience newer rollup economies without leaving the ETH ecosystem.

#4 Bounce Bit

BounceBit is specifically designed to restake BTC-based assets, which are often considered “idle” in traditional Bitcoin usage. This platform permits users to restake wrapped versions of BTC like WBTC or BBTC and earn yields.

BounceBit utilizes a distinctive dual-token Proof-of-Stake (PoS) system, secured through staking wrapped BTC along with its native “BB” token. This project aims to blend Bitcoin’s strong security with the adaptability and earning potential of DeFi.

So, are you preparing to restake your assets? Wait. Before re-staking your tokens, you need to understand…

Things You Need To Know Before Restaking Your Assets

The concept of restaking might look attractive and more beneficial. However, it has some drawbacks. If you’re planning to restake your assets, then you must be aware of some things. Here I’ll list out what they are:

#1 Smart Contract Risks

When restaking, your assets may interact with multiple layers of protocols. If any one of them fails with weak smart contracts, then you end up losing your initially staked assets. That’s why it’s always advisable to review audits and documentations before restaking on any platforms.

#2 Slashing Risk

If you restake your assets on various networks, then there is a chance you will lose your assets on one or more networks if something goes wrong. For example, if a validator (someone who helps run the network) misbehaves, you might lose some of your assets on each of the networks where you’re restaked.

#3 Liquidity Concerns

When you restake, some platforms might provide new tokens to represent your staked assets. But those new tokens can sometimes be hard to convert into money or trade on platforms. And, some platforms may not accept those new tokens for trading. This results in taking out restaked tokens from the platform, which creates stress and consumes users’ time.

#4 Points Farming VS Real Rewards

Not all, but many restaking protocols are now in the “points” stage. This means participants in restaking are limited to earning points as their primary benefit. These points can be turned into airdrops later, but there is no promise. So, it’s safer to choose platforms that already give token rewards or have a clear plan for how users will earn.

Important: There are many DeFi restaking platforms emerging currently in the DeFi sector. Every platform has its own set of benefits and challenges, so make sure to do your own research before engaging in restaking.

Great! You’ve explored a lot about restaking and likely have a clear understanding by now. If you want to keep up with the latest DeFi trends and business insights, SUBSCRIBE to our blog for regular updates. SHARE IT with your friends or network to help them stay informed.

Final Thoughts

The DeFi is upgrading consistently and helping users to do more with their assets without any hassles. Here, Restaking brings a new layer of opportunity without forcing you to add new capital or abandon your existing strategy.

But what if I told you that you can generate consistent income in the DeFi space without making any trading, staking, or restaking?. Wondering how? Yes, it’s possible, if you’re an entrepreneur or a person thinking of building your own venture in the DeFi space, then you can make income by creating your own DeFi protocol. So, you can make income every time someone trades, stakes, or interacts with your platform.

Forward-thinking entrepreneurs are stepping into this space now. By starting early, you can grab numerous benefits in the DeFi space.

Thinking about where to build your own platform for your DeFi venture?

You can also hire experts from Trioangle. As a top DeFi development company, we build comprehensive DeFi protocols that serve the needs of your businesses. Our team considers your specific requirements and delivers customized solutions to help you launch a unique protocol in the DeFi space.