Planning to store your assets in a safe wallet? Well, you’re at the right pace, traders! But there are various crypto wallet types available with multiple variations. If you think a crypto wallet is just like your regular wallet where you stash cash and cards, think again.

In the crypto universe, wallets don’t hold coins. They have the keys that prove you own those coins on the blockchain. These keys are the digital passports to your crypto assets, controlling access, transfers, and security.

Whether you’re a beginner or an experienced trader, you’re juggling multiple tokens. Knowing how crypto wallets work and the differences between custodial and non-custodial options is crucial.

Key Takeaways

- What are crypto wallets, it’s types, and how do they work.

- Popular Custodial and non-custodial, hot and cold crypto wallets types with comparison.

- Why securing your private keys is the number one rule in crypto.

- Case study of my personal experience(why wallets are essential).

Ready to take control of your digital assets and avoid common pitfalls? Let’s start now.

What is Crypto Wallet?

A crypto wallet is a software application that allows you to store, send, receive, and interact with cryptocurrencies. Sounds like a normal wallet, right? But a wallet doesn’t mean storing coins like cash.

So what do crypto wallets store?

Rather, it stores private keys that prove ownership of crypto on the blockchain. Combined with public keys (or public addresses), they let others send coins to you, and let you send coins out.

- Public key: Well, this is like your email address. You can share it; others use it to send you crypto.

- Private key(seed phrase): This is like your password plus backup, only you should ever see this. If you lose it, you lose access.

What are Private and Public Keys?

- Public Key: The address people can use to send you crypto. Visible on blockchain, shareable.

- Private Key: The secret map that proves you own what’s at that public address. If someone has this, they control the funds. If you lose this, there often is no recovery unless some special wallet feature exists.

So: Public + Private keys together = how crypto wallets work. Important, because different types of crypto wallets protect or expose these keys in different ways.

Crypto Wallet Types: Custodial and Non-Custodial Wallets

Custodial Wallets: In these, a third‐party, like an exchange like Binance, Coinbase, holds your private keys. You trust them with safekeeping. That means if you forget your password, need customer support, or need recovery, they help.

But it also means you’re trusting someone else with control. If the custodian has problems (hack, regulatory freeze, insolvency), you may lose access.

Non‑Custodial Wallets (often called “self‑custody”): You, and only you, hold your private key/seed phrase. No third party can freeze or lock your funds. You’re fully responsible: backup, security, recovery. If you mess up, there’s usually no safety net.

Hot Wallet and Cold Wallet

Another important classification relates to how “online” your wallet is. Here we’re segregating the crypto wallet types into online and offline access.

- Hot Wallets: Online or connected to the internet software wallets (mobile, desktop, browser extension). Very convenient for trading, DeFi, and everyday transactions. But more exposed to hacks, phishing, and vulnerabilities.

- Example: Coinbase Wallet, Trust Wallet, Phantom Wallet, Exodus, Electrum

- Cold Wallets: Offline storage. This could be a hardware wallet (USB‑like device), paper wallet, or other offline methods. Much more secure from remote/online threats. Cold wallets are less convenient for frequent transactions.

- Example: Ledger, Trezor, CoolWallet

How do Crypto Wallets Work?

Here’s a simplified flow of how crypto wallets work under the hood.

- Generation of a key pair

The wallet software generates a private key and a matching public key.

- Address creation

From the public key, you derive a public address, which people use to send crypto to you.

- Transaction

When you want to send crypto, your wallet software creates a transaction, signs it with your private key. And broadcasts it to the blockchain network.

- Verification/Confirmation

The blockchain nodes verify the signature, ensure you have sufficient funds, etc. After confirmation, the transaction is final.

These are the general workflow of all the crypto wallet types. If the wallet is custodial, some of those steps (especially storage of private key, broadcasting) are handled by the custodian. If non‑custodial with a cold wallet, more of the work and responsibility is on you.

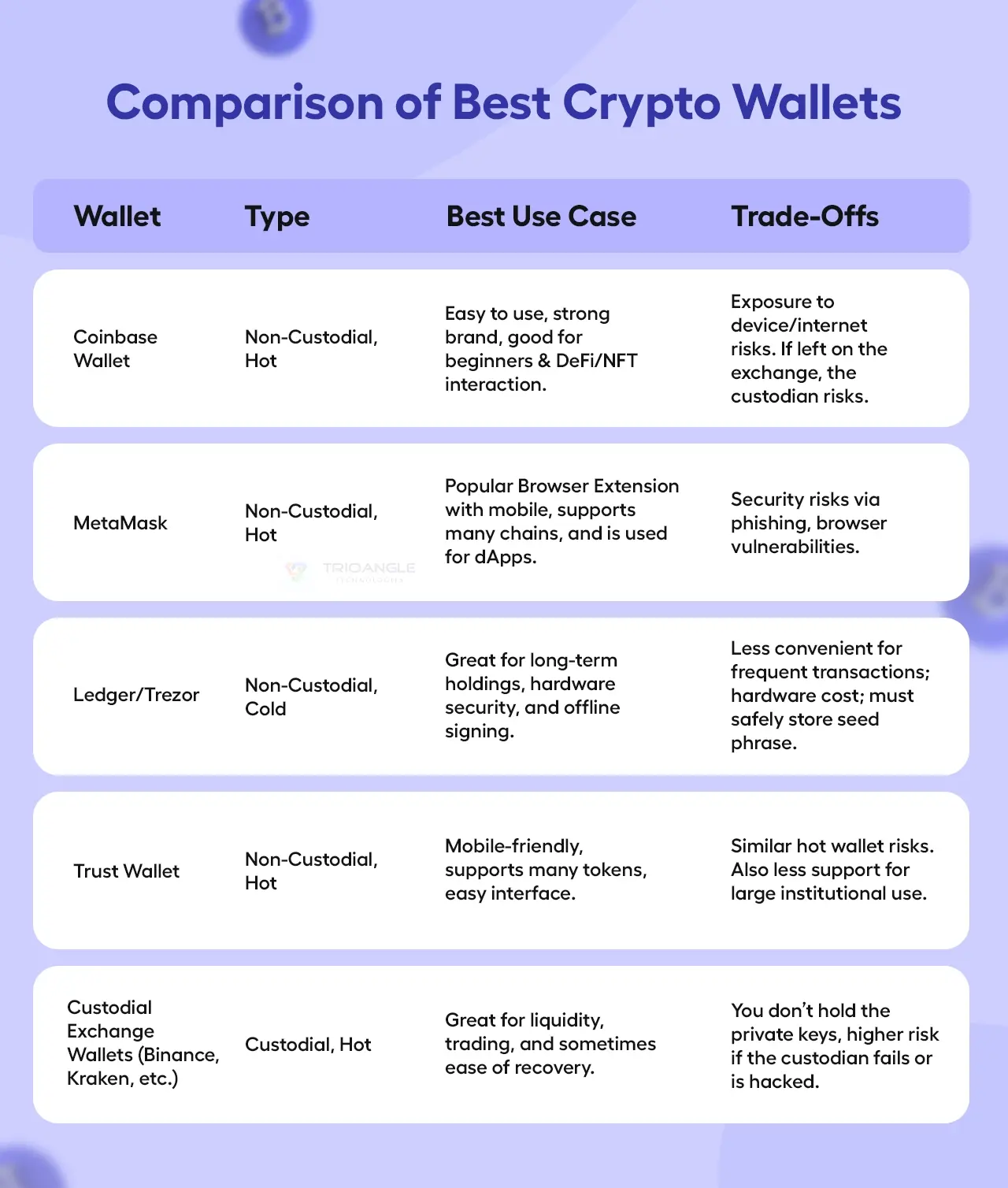

Comparison of Best Crypto Wallet Types

Since people will want actual names, here’s a rough comparison (not exhaustive) of well‑known wallets, their pros & cons, especially in different wallet types.

Related: How to use a Coinbase wallet to manage digital assets

Choosing among these depends on what matters most for you. Security vs convenience, frequency of transactions, and how much crypto you hold. Also, how comfortable are you managing your keys?

What if the private key is lost?

We’ve seen enough ot the best crypto wallet types available in the market. Ah, this is one of the scariest scenarios for crypto users. Here’s what happens and what to do.

- If the private key (or seed phrase) is lost in a non‑custodial wallet, usually, access cannot be recovered. No one can restore it unless you have backups. That means those funds are gone for good.

- Some wallets offer social recovery, multi‑sig, or backup mechanisms (e.g., hardware wallet + paper backup + encrypted cloud backup) to help mitigate loss.

- In a custodial wallet, loss of access (forgot password, etc.) often can be resolved via customer support, identity verification, etc. But you’re trusting the custodian.

- Best practices: store seed phrases securely (offline, multiple backups). Do not store private keys or seed phrases in plain text or easily hackable locations. Consider using cold storage for large sums.

Why Crypto Wallets are important?

Many think, my assets are controlled and ensured by the admin of the particular centralized crypto exchange. Why should I wanna have an external wallet of my own?

Yeah, it’s right. I don’t deny. When you put your assets in an exchange’s wallet, your balance will get updated with your maintained assets on your dashboard. But technically, all the users’ assets are being stored in the admin’s wallet.

Here are the major reasons why you need an external crypto wallet types like Metamask.

#1 Ownership Confusion

Crypto exchange platforms like Binance, KuCoin custody the private keys. Crypto wallets, especially non-custodial wallets like MetaMask, give users full ownership of their assets through private key management.

#2 Security & Risk of Hacks

The Centralized crypto exchanges are prone to hacking. Billions of dollars have been lost to exchange breaches (Mt. Gox, FTX).

With a non-custodial wallet, users are responsible for their own keys. Cold wallets (hardware wallets like Ledger, Trezor) store keys offline, making them nearly immune to online hacks.

#3 Privacy and Surveillance

Centralized exchanges are required to comply with KYC/AML laws. This means that user data and transaction histories are tied to real identities.

Crypto wallets execute transactions with the keys(addresses). While blockchains are transparent, wallet addresses aren’t directly linked to personal identity unless the user reveals it.

#4 Lack of Interoperability

If you rely on a crypto exchange’s wallet, then you can access your assets on other platforms, blockchain networks, or dApps. Many of the centralized exchanges are solely for trading, staking, launchpad, and loans.

But NFT marketplaces and DeFi platforms use cases are beyond that. This restricts your trading potential within that particular platform itself.

To access all the features of dApps and other blockchains, you need external wallets. This helps you easily interact with DeFi protocols and others with full control and flexibility.

Case Study: My Personal Experience

Well, let me tell you a case study here. Your real-time example for a trader is me. For a long time, I too believed in Binance-like platforms and stored my assets there. But when I started arbitrage trading, I found it hard to transfer my assets over there.

And that’s when I realized that I haven’t owned my assets. And the admin of the exchange owned my assets. Then I opened the Metamask wallet and transferred my assets. Then I transferred my assets to another exchange and performed an arbitrage trading strategy.

Well, what else do you need more than this? It’s quintessential for a crypto trader to possess a crypto wallet. We’ve seen more crypto wallet types like hot and cold. And that too, I recommend using a non-custodial wallet like Metamask and Trust Wallets.

Also, possessing cold storage is the best option for all the traders, from beginners to pro traders. This offline storage option enables you to safeguard your assets from any hack or fraudulent activities.

Trends and Adoption in Crypto Wallet

Now, what are people actually doing with wallets right now? What are the trends? Because these tell us where the world is heading.

- The global crypto wallet market is expected to reach about USD 100.77 billion by 2033, growing at a CAGR of ~26.3% from 2025 onward.

- Another report values the market at around USD 13.77 billion in 2024, projecting sharp growth to USD 153.88 billion by 2033.

- Usage: mobile wallets hit a record high of 36 million active users in Q4 2024, per Coinbase data.

- Hot wallets dominate usage: in recent stats, ~78% of crypto wallets are hot wallets, while ~22% are cold wallets, as people seek both convenience and increasing security awareness.

- Custodial vs non‑custodial split: about 59% of users prefer non‑custodial wallets, 41% still use custodial types.

- Devs and wallet providers are including more features: multi‑chain compatibility, NFT/DeFi integration, biometric security, push alerts, etc. According to one market analysis, over 41% of new wallets launched include DeFi integration & cross‑chain compatibility.

While many want ease & convenience (custodial, hot wallets), a growing chunk of the community is moving toward self‑custody, stronger security, and cold storage crypto wallet types. Especially for larger sums or long‑term holdings.

Final Takeaway

So what should you, as a crypto user or trader, take away from all this?

- Understand the crypto wallet types (custodial vs non‑custodial; hot vs cold). The trade‑offs are almost always convenience vs security/control.

- If you’re active, frequent trading, interacting with dApps, DeFi, NFTs, hot wallets, or custodial wallets may make sense for a particular part of your funds. But don’t keep everything there.

- For long‑term holdings, large amounts, or peace of mind, cold wallets + non‑custodial control + backups are essential.

- Using hybrid strategies works: small everyday crypto in a hot wallet; bulk in cold storage.

- Always guard your private key or seed phrase. Once lost (or stolen), it’s usually gone beyond recovery.

If you found this useful, make sure to subscribe so you don’t miss more insights like this, deep dives, wallet recommendations, and security tips. Crypto is growing fast; staying informed is your best defense.

More to Explore

- Best crypto to invest now: Top picks investors are eyeing!

- Spot, Margin Vs Futures Trading: Key Differences Explained

- Top 10 Crypto Trading Strategies You Need in 2025

FAQs

What are the best crypto wallet?

Depends on your needs. For security and control, a hardware wallet (cold, non‑custodial). For ease and frequent use, a reputable hot wallet or custodial wallet with good security.

What crypto wallet should I use?

If you’re new, start with a user‑friendly hot or custodial wallet. As you grow more comfortable and hold more, transition some funds to non‑custodial / cold storage.

What are the different types of crypto wallet?

Broadly: custodial vs non‑custodial; hot vs cold. Also, there are hybrids (like tools that offer non‑custodial custody but convenient recovery, or hardware + mobile‑app components).

What crypto wallet is the best?

“Best” depends on your priorities: security, control, ease of use, and cost. If security is your priority, a cold non‑custodial wallet is best. If convenience and quick trades are a priority, a custodial hot wallet may be best.

What are blockchain wallet types?

Types of crypto wallets are custodial/non‑custodial; hot/cold. With further distinctions like hardware, software, mobile, browser extension, and multisig wallets amongst non‑custodial ones.

What is the best crypto wallet to have?

Ideally, a combination: one safe cold non‑custodial wallet for your savings / long‑term holding. Plus one hot/custodial wallet for flexible use. That gives balance.