Are you considering starting your own cryptocurrency exchange but are concerned about the costs? Or you’ve heard about OTC platforms and want to know the real cost to build an OTC exchange before making a decision.

If so, you are not alone. Many entrepreneurs are looking into OTC exchanges as a profitable way to enter the cryptocurrency market. But the truth is that the cost is not fixed. Numerous critical criteria, including the development plan, features, security, and compliance with applicable rules and regulations determine it. In this blog, we’ll go over everything you should know before starting your OTC exchange experience.

What is an OTC Exchange?

An OTC (Over-the-Counter) exchange is a cryptocurrency trading platform that facilitates large-volume transactions between buyers and sellers. Unlike traditional exchanges, which rely on public order books, OTC exchanges offer secure and confidential transactions, making them perfect for institutional investors, high-net-worth individuals, and corporations doing large-scale cryptocurrency trades. The primary benefits of OTC exchanges are:

- Reduced price disruption in large trades.

- Faster settlements

- Improved privacy and security.

- Access to improved liquidity

This is why OTC systems are gaining popularity as the cryptocurrency market expands.

Key Factors That Influence the Cost to Build an OTC Exchange

When determining the Cost to build OTC exchange, numerous aspects have a direct impact on the budget.

Development Model

Selecting between a white-label OTC exchange script and a custom-built platform.

Security features

It includes KYC/AML, multi-signature wallets, two-factor authentication, and cold storage.

Compliance Requirements

Comply with regional legislation such as GDPR, KYC, AML, and other regulatory structures.

Liquidity Setup

Integrating with liquidity providers to improve trading performance.

UI/UX Design

An interface that is easy to use improves trust but increases development costs.

Maintenance and Scalability

after that, you can Continuous upgrades and system capacity for future expansion.

Estimated Development Cost of an OTC Exchange

The cost to build OTC exchange varies greatly based on the proven business model requirements and technological stack selected.

- White-Label OTC Exchange Script: $10,000 to $20,000.

- Custom-designed OTC exchange: $80,000 to $150,000+

Additional expenses

- Security upgrades: $10,000 to $30,000.

- Compliance and legal: $15,000 to $50,000.

- Liquidity integration: $5,000 to $20,000.

- Maintenance: $2,000 to $10,000 per month.

Essential Features Your OTC Exchange Must Have

To ensure success and confidence among consumers, your OTC exchange should contain,

- Advanced security protocols include KYC/AML, encryption, and multi-sig wallets.

- Escrow system for secure fund transfers.

- High liquidity support for high-volume trading.

- Multi-Currency Support to Draw Global Users

- Admin and user dashboards for convenient management.

- Automated Trade Settlement can speed up deals.

- Compliance Tools for Meeting International Regulations

Therefore, they are including these elements guarantees that your exchange remains secure, scalable, and competitive in today’s rapidly expanding cryptocurrency market.

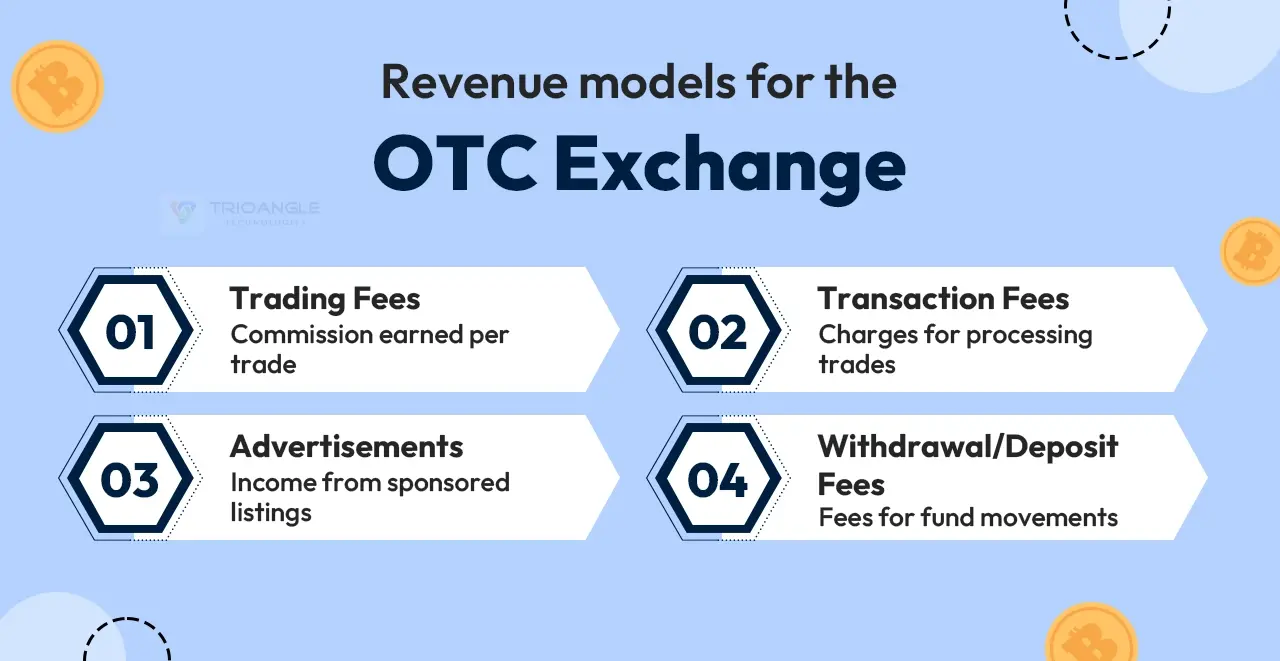

Revenue Model: How OTC Exchanges Make Money

Here are some of the high-range revenue streams, which are living in the OTC exchange. The above image has the main revenue streams for more. You can refer to the following fees.

Trading Fees

Trading fees are a percentage or spread levied on each transaction and serve as the primary source of income.

Transaction Fees

Additional charges for blockchain network expenses and internal transaction processing.

Advertisements and promotions

It generates revenue through sponsored token listings, prominent positions, and marketing initiatives.

Withdrawal and deposit fees

It applies when users move cryptocurrency or money into and out of the platform.

Listing Fees

New coins or projects pay to be featured on the site, which generates a consistent cash stream.

Premium Services

A large number of traders and institutions pay more for speedier settlements, dedicated support, and exclusive features.

API and Integration Fees

Third-party services and enterprises are charged for using APIs or integrating volatility solutions.

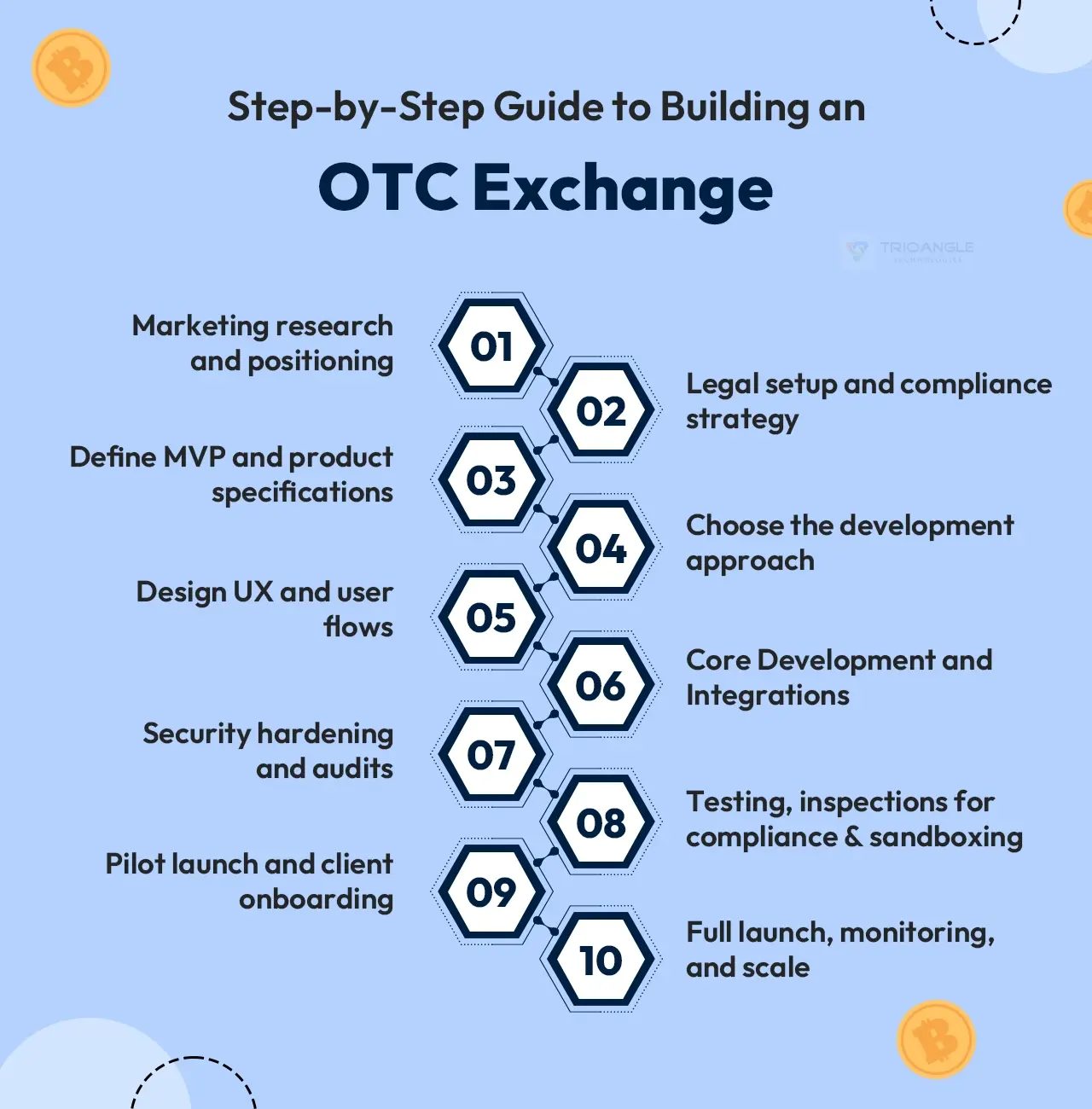

Step-by-Step Guide to Building an OTC Exchange

A defined, stepwise approach helps control the cost to build OTC exchange while providing a solid offering that clients trust.

Marketing research and positioning

- Define your target audience, such as institutions, family offices, and brokers.

- Examine rivals, fee structures, and regulatory conditions in your target countries.

Legal setup and compliance strategy

- Engage legal guidance to determine the best structure and secure the essential licenses and registrations.

- Create AML/KYC, penalties screening, privacy, and documentation procedures.

Define MVP and product specifications

- List the essential functionalities like trade capture, settlement/escrow, KYC, custody integration, and reporting.

- To control initial development costs, distinguish between must-haves for launch and nice-to-haves.

Choose the development approach

- Decide whether to white-label or custom-construct. White-label crypto exchange saves time-to-market and upfront costs, whereas a custom one provides personalized workflows and branding.

- Consider in-house versus outsourced versus hybrid teams.

Design UX and user flows

- Create straightforward onboarding flows for close client account managers, document upload, and limits.

- Create dashboards for trading, compliance, and back-office operations.

Core Development and Integrations

- Create trade, quotation, and pricing tools, settlement and escrow engines, and accounting.

- Integrate custody like cold and hot wallets, liquidity providers, banks/payment gateways, and KYC/AML suppliers.

Security hardening and audits

- Create multi-signature and cold-storage wallet configurations, encrypted data stores, and role-based access.

- Prior to going online, perform hacking and third-party security audits.

Testing, inspections for compliance & sandboxing

- Perform functional, load, and failover testing, and confirm reconciliation and settlement accuracy.

- When possible, use a sandbox for regulation to verify compliance workflows.

Pilot launch and client onboarding

- Begin with a small group of reliable customers to test real deals and improve SLAs.

- Educate account managers, operations, and legal teams on processes.

Full launch, monitoring, and scale

- Once systems are established, broaden your marketing and cooperation opportunities.

- Implement 24/7 alerting, customer support, issue response, and ongoing compliance updates.

Future Market Trends for the OTC exchange

- The OTC cryptocurrency market is rapidly increasing, with billions of trades every day and increasing interest from institutions and wealthy investors.

- Privacy, liquidity, and lower slippage make OTC platforms more appealing than established exchanges.

- For business owners, the cost to build OTC exchange is not only an outlay but an investment for the future.

- With usage increasing, creating a secure, compliant, and accessible OTC platform now positions organizations to capitalize on future development and dominate high-volume crypto trading.

Conclusion

Hence, the cost to build OTC exchange is a strategic investment. Working with a reputable OTC Crypto exchange script guarantees a secure, compliant, and feature-rich platform. With experienced advice, you can launch quickly, scale seamlessly, and capitalize on high-volume trading possibilities in the expanding OTC crypto market.

Start your OTC exchange today