AMM DeFi is quietly rewriting how ambitious founders launch their startups. It’s opening doors for new businesses to avoid the struggles most first-time ventures face.

Imagine you’re a new founder stepping into the crypto world to build a DEX platform. To be honest, most crypto startups struggle in the early stages. They find it difficult to attract liquidity providers, gain users’ trust, and overcome other challenges. It can truly feel like climbing a mountain with no clear path.

Here’s where Automated Market Maker (AMM) models in DeFi change the entire game. It helps DEX platforms manage liquidity automatically. This means new DEX platforms don’t rely on finding buyers and sellers all the time.

The result? DEX platforms can attract more LPs and users from the start.

This is the reason why most forward-thinking DEX startups are looking to build AMM-powered DeFi platforms.

This blog explains everything you need to know about Automated Market Makers (AMM). At the end of this article, you’ll know the true potential of AMMs and where to build a robust venture by implementing this technology.

Ready? Let’s get started!

So, let’s start by understanding the concept first.

What is Automated Market Making?

Automated Market Making is a concept used in decentralized finance (DeFi) protocols that enables on-chain automated trading through liquidity pools.

In traditional or centralized crypto exchange platforms, trades occur based on an order book. In CEX, buyers list the prices they’re willing to pay, and sellers list the prices they’re willing to accept.

Here, a trade only happens when the system finds a matching buyer and seller. However, if there are no matching orders at the expected price, the trade may not go through.

Here, the concept of Automated Market Making allows users to trade directly by relying on the platform’s liquidity pools. Users don’t need to wait or depend on other buyers for a trade.

Now, you know the concept of automated market making, so let’s see…

What is an Automated Market Maker (AMM)?

The Automated Market Maker (AMM) is a technology or key feature that powers decentralized exchanges by enabling users to trade instantly through liquidity pools, without relying on traditional order books. It manages the liquidity pool, sets token prices, and ensures that the system works without interruptions.

To make it easier to understand, let me give you a simple example.

Imagine this: You’re going to a shop to buy things for yourself. You have picked up the items you want, and as you leave, an automated system instantly charges your bank account based on what you’ve taken. There’s no cashier and no need to wait in line. The system works continuously, as long as the store has inventory.

The AMM works similarly.

This method helps new DEX platforms bring in more users and keep liquidity steady, which opens up better chances for startups to grow. Because of this, AMM DeFi is becoming really popular, and many individuals and entrepreneurs are now planning to build protocols using AMMs.

So, if you’re the one planning to build an AMM-driven DEX platform, then you need to know…

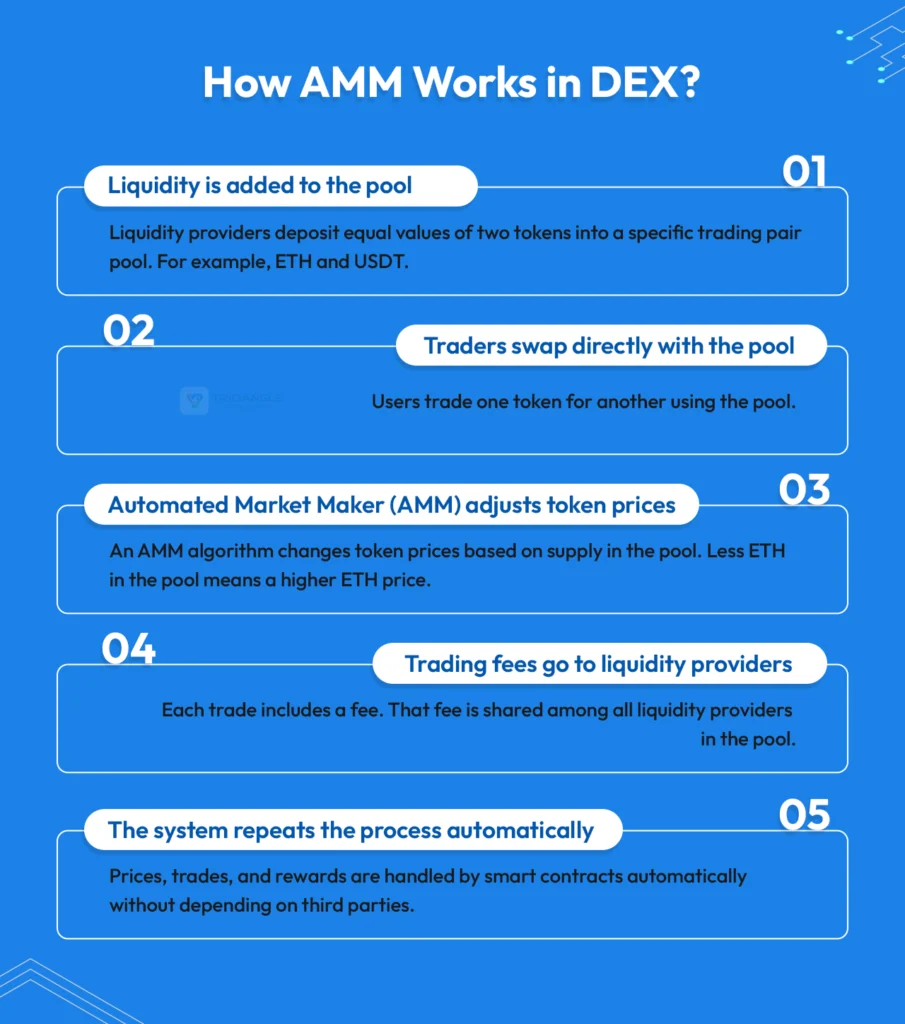

How Does AMM Work in DEX?

Here’s an explanation of how AMM operates. Automated Market Makers are mostly equipped on DEX protocols, so let’s see how it works on DEX.

1. Liquidity Providers Add Tokens to the Pool

- Each trading pair (e.g., ETH/USDT) has its own liquidity pool. Liquidity providers add an equal value of both tokens to the appropriate pool.

- Let’s say a user might add $5,000 in ETH and $5,000 in USDT to a liquidity pool.

2. Traders Swap Tokens Directly with the Pool

- Now, a trader comes to swap ETH for USDT (or vice versa).

- They don’t need another buyer or seller; the pool itself gives them the tokens instantly.

3. The AMM Algorithm Adjusts Prices Automatically

- After each trade, the AMM adjusts the price of each token based on how many tokens remain in the pool.

- It relies on a mathematical formula to set the ideal token price, like (x*y=k), used by platforms such as Uniswap.

- As more users buy ETH from the pool, ETH becomes scarcer and more expensive. Likewise, selling ETH increases USDT in the pool, adjusting its price accordingly

4. Liquidity Providers Earn Trading Fees

- Every trade charges a small fee (e.g., 0.3%).

- This fee is shared among all liquidity providers based on how much they’ve contributed to the pool.

5. The Cycle Repeats Automatically

- The cycle continues automatically around the clock, with no manual control.

- If the pool has more liquidity, then the trades will be smoother and traders will experience lower slippage.

But here’s a twist: there are many types of AMMs, and they employ different formulas. That’s why it’s important to know…

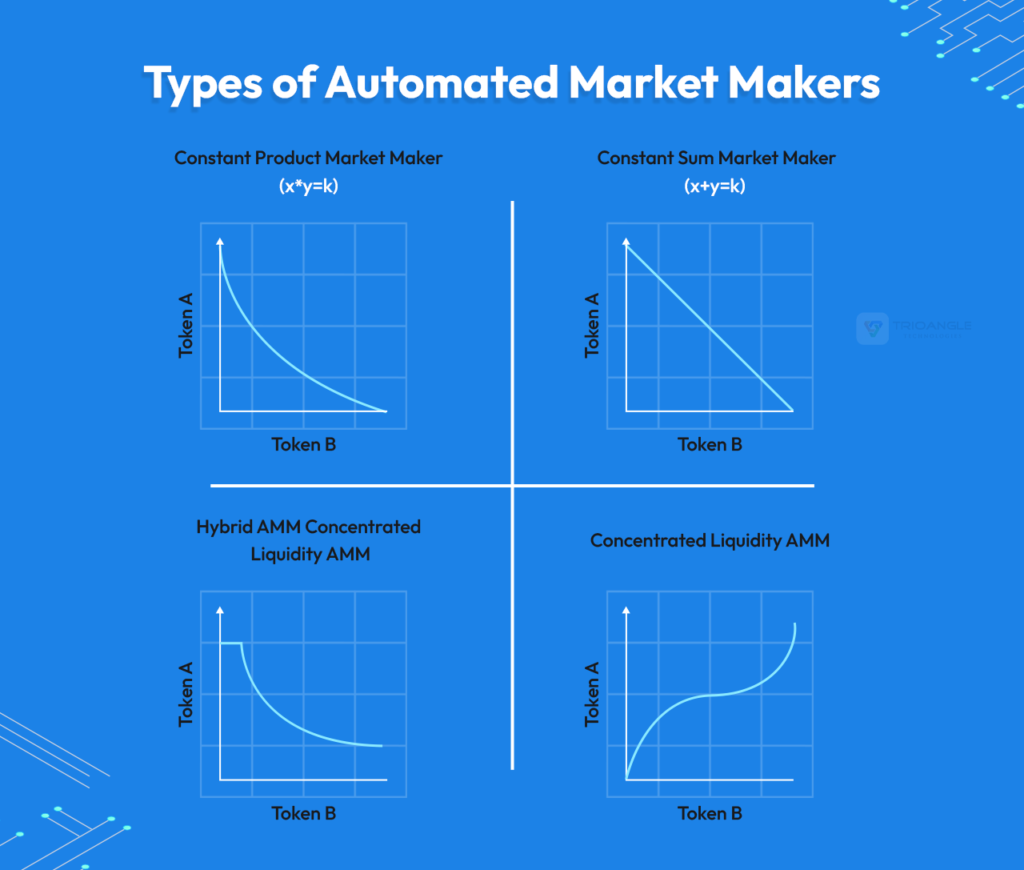

Types of Automated Market Makers

Different AMMs serve different use cases. Here’s a breakdown of the various types of Automated Market Makers (AMMs).

1. Constant Product Market Maker

This Constant Product Market Maker uses ( x * y = k ) formula. This mechanism is commonly used on most DEX platforms. And, this model gets popularized by the Uniswap protocol.

Here’s a practical example of how this formula works.

- Imagine this: you deposit $50,000 of ETH alongside $50,000 of USDT into the pool.

- Assume 1 ETH = $5000.

- Now, it should be multiplied: 5000*10 = 50000.

So you add:

- 10 ETH and 50,000 USDT.

Now, the AMM formula is: x*y = k.

- x = 10 ETH.

- Y = 50,000 USDT.

- k = 10 × 50,000 = 500,000 (This value is constant and it won’t change).

Now, someone buys ETH using USDT.

Let’s say a trader wants to buy ETH. So, he supplies the pool with 10,000 USDT.

Now:

- New y = 50,000 + 10,000 = 60,000 USDT.

- To keep k = 500,000, the algorithm calculates:

- New x = 500,000 ÷ 60,000 ≈ 8.33 ETH.

So,

- The pool now has 8.33 ETH.

- The buyer gets 10 – 8.33 = 1.67 ETH.

So, what happened here?

- The amount of ETH decreases in the pool, which makes ETH more expensive.

- The amount of USDT increases in the pool.

- Using the AMM formula (x * y = k), the price updates itself automatically.

- Additionally, this formula allows for continuous liquidity, even if one side of the pool gets very small.

I hope you now have some clarity about how the AMM formula works. Up next, we’ll review the other types.

2. Constant Sum Market Maker

- Using the formula (x + y = k), the Constant Sum Market Maker keeps the combined quantity of both tokens constant.

- This model works best when the prices of both tokens are expected to remain close to a 1:1 ratio.

- In short, as more of one token is bought, its price goes up. This simple rule keeps the pool balanced and ensures trades can happen anytime

- However, one issue with this model is that it can run out of liquidity if one token is depleted, which is why it is less commonly used in DeFi today.

3. Hybrid AMM

The hybrid AMM method was already implemented on well-known platforms like Curve Finance. They use hybrid formulas to support tokens with similar prices (eg, stable coins).

- It works by combining the constant product and constant sum formulas. As a result, it offers efficient trades and low slippage.

- This type of pool is ideal for swapping stablecoins or pegged assets.

- The model works like a constant sum AMM when token prices are similar, but switches to a constant product model as the prices move further apart.

4. Concentrated Liquidity AMM

- Concentrated liquidity was first implemented in Uniswap v3 and became widely popular through that platform.

- With this model, liquidity providers can choose specific price ranges where they want their funds to be active.

- This increases capital efficiency and can generate higher returns for liquidity providers.

- This approach works especially well for assets that tend to trade within stable or predictable price ranges.

- However, it has some drawbacks. Concentrated liquidity requires LPs to constantly monitor their positions and re-allocate their capital if the price moves outside of their chosen range. If the price leaves the range, the LP stops earning fees and is left holding only the less valuable asset.

For example:

- Let’s say you provide liquidity for a USDC / DAI pool.

- These are both stablecoins, usually worth about $1 each.

- So, you can pick a narrow price range, such as $0.99 to $1.01, instead of a broad one.

- Because most trades happen in that range, your money is used more efficiently, and you earn more fees.

Now that you’ve mastered the basics of AMMs and their formulas, it’s time to reveal why you really opened this blog.

Why Are Startups Looking For AMM DeFi?

Here’s the reason why DEX startups are more attracted to AMM DeFi.

#1 Liquidity From Day One

New platforms mostly struggle to attract traders and market makers. Here, AMM DeFi solves this struggle by letting anyone contribute liquidity on the platform.

#2 Hassle-Free Onboarding

Users can start trading immediately without waiting for traders. This approach helps even a newbie to provide liquidity on the platform.

#3 Proven Success Stories

AMM technology has helped many platforms rise to prominence and establish themselves as strong brands in the DeFi sector.

For example, Uniswap, PancakeSwap, and Curve collectively process a daily trading volume that frequently exceeds $1 billion. In mid-2025, DeFi platforms held a total value locked of more than $50 billion. These numbers highlight the strong market demand and widespread user adoption.

So, if you’re considering building a DEX with the AMM feature, then you must know about both sides of the coin. Let’s explore the other side you need to know.

Challenges Of AMM DeFi

Understanding the challenges helps you plan and overcome struggles while scaling your AMM-based DEX software. So, let’s take a look at the risks of AMM.

#1 Smart Contract Security

Issues or mistakes in the platform’s smart contract can lead to risks. Regular code audits are highly recommended.

#2 Impermanent Loss

Sometimes, liquidity providers of your platform can face losses when the token price fluctuates suddenly.

#3 Regulatory Landscape

As the DeFi sector advances, it is attracting more attention from regulators, so following the DeFi regulations is more important than ever. It’s always advisable to consult with a legal expert who understands the blockchain space. Doing this protects you from future complications.

#4 Price Slippage

Every AMM-based DEX faces slippage issues when liquidity is low. It’s a hidden risk that hurts trading precision and discourages repeat usage if not addressed early with proper liquidity incentives.

The Future Of AMM DeFi And Your Opportunity

The DeFi sector is growing at an unprecedented pace. Many traditional financial institutions are planning to integrate blockchain technology into their systems, a trend known as Institutional DeFi. As more people enter the crypto and blockchain space, the number of users engaging with DeFi will continue to rise. This creates a golden opportunity for entrepreneurs and startups to generate significant profits by offering decentralized exchanges (DEXs).

A DEX with AMM technology can really help you stand out and succeed in this competitive market.

Moreover, the future of AMM DeFi looks good, and by entering the space today, you can unlock great benefits and growth potential.

Final Thoughts

AMM DeFi is not only a theoretical concept; it changes the DeFi sector by providing numerous benefits for users as well as platform owners. So, if you enter the market quickly with an AMM-based DEX solution, you can establish a strong name in the DeFi sector before the market gets more crowded with competitors.

Now, some might think, “Which is the best and trusted place to build my AMM-based DeFi solutions?”

The perfect answer for this question is “Trioangle Technologies”. As industry leaders in decentralized exchange development, we offer expert AMM-based DEX solutions tailored to your needs.

The opportunity is here today. The question is, are you ready to build a DEX powered by AMM and take a leading role in the future of decentralized finance?

Get the freshest DeFi insights sent directly to your inbox! SUBSCRIBE now, and be sure to share it with all your friends!