Have you ever wondered how successful traders control risk while maintaining profits in volatile, quick-moving markets? Technology is the solution, not pure luck. Your trading partners who never sleep, panic, or miss a market signal are AI Agents in Margin Trading. These advanced systems forecast market moves, evaluate vast volumes of real-time data, and automatically execute trades at precisely the right moment. Even when the market becomes volatile, they help you manage leverage, prevent liquidations, and maximize returns. AI agents improve the intelligence, security, and strategy of your margin trading, regardless of your level of experience.

Understanding Margin trading with a Quick recap?

- A margin trading clone script is a ready-made software solution. It will allow the traders to borrow the trades between the Buyer and seller.

- They trade with leverage, which is money borrowed from the exchange or broker, rather than just their own money.

- This raises the possibility of both gains and losses. With 5x leverage, for instance, a 10% price increase results in a 50% profit, while a 10% loss might destroy your stake.

- AI agents in margin trading to optimize decisions and reduce risks in this high-risk, high-reward model.

Why AI Agents Are a Game Changer in Margin Trading

- It will operate 24 hours per day, not like human traders.

- The AI agents in margin trading allow you to analyze the real-time large datasets.

- The Margin traders execute the trade quickly and accurately.

- It is unaffected by emotion or fear.

- It can automatically set or adjust the order type, like stop-loss and take-profit.

- The AI in margin trading quickly responds to new market trends or shifts.

- Portfolios should be rebalanced without human involvement.

- Ideal for both beginners and seasoned margin traders.

Related: Emergence of Margin Trading Platforms

Risk Management Through AI: Smarter, Safer Trading

- In the AI agents’ margin trading clone script, keep a close eye on market volatility.

- Leverage should automatically change according to risk levels.

- Monitor and control margin levels instantly.

- Avoid margin calls by managing trades proactively.

- Stop losses should be executed promptly and without hesitation.

- To reduce exposure, model various trading outcomes.

- Implement emotionless, rigorous risk management techniques.

- Minimize the likelihood of complete liquidation during sharp fluctuations in the market.

- The AI agents’ margin trading provides comfort by automating risk management.

How AI Agents Predict Market Movements

AI agents make decisions based on facts rather than intuition. The algorithms used estimate price patterns using real-time charts, historical data, and even news mood. For traders and exchanges seeking a guaranteed business model, these findings provide performance consistency and reliability.

- Technical analysis includes RSI, MACD, and moving averages.

- Sentiment analysis covers social media patterns, news headlines, and community buzz.

- Pattern identification is the practice of identifying repeated price movements based on past patterns.

By integrating these techniques, AI Agents in Margin Trading can produce faster and more accurate predictions, giving users an advantage in timing their inputs and exits.

AI-Driven Trading Strategies That Maximize Returns

There are some more strategies in the AI-based margin trading techniques. they are

Scalping

- It is used for AI agents in margin trading to execute dozens of small trades in seconds.

- It takes the Profits from minor price changes.

- Ideal for volatile markets with the help of AI.

Grid Trading

- It can set the buy and sell orders in a fixed interval.

- Profits from sideways or volatile markets.

- There is no requirement for trend direction, only movement.

Trend following

- These AI agents in margin trading follow both upward and downward market trends.

- You can enter earlier and exit before the market trends reverse.

- You can employ indicators such as the MACDI and RCI.

Automated stop-loss and take-profit

- Thresholds are adjusted based on volatility or momentum.

- Effectively locks in gains or reduces losses.

Smart portfolio and rebalancing

- Quickly reallocates assets based on the strength of the market.

- This can allow for maintaining the ideal risk or reward ratio.

- Removes underperforming assets without hesitation.

These tactics, which rely on real-time data, make AI agents in margin trading extremely effective at generating consistent profits.

Real-Time Decision Making with Zero Emotion

The AI agents, like the AI crypto trading bot, are supposed to reason logically and act in real time, with no emotional biases or second-guessing.

Instant Execution

- Places transactions as soon as a trigger condition is met.

- Reacts to price variations in milliseconds.

Emotion-free Trading

- There is no panic selling during trading falls or FOMO buying during surges.

- Maintains trading rationality and discipline.

24/7 Consistency

- Does not suffer from weariness, stress, or diversions.

- Maintains trading methods without deviating.

Predetermined Strategy Enforcement

- Follows rule-based logic without deviating or questioning.

- Removes emotional disturbance in decision-making.

Prevents Overtrading

- Trade only when certain circumstances are met, not out of boredom or fear.

- Avoids illogical, emotion-driven blunders.

With AI Agents in Margin Trading, you have a trader who never sleeps, stresses, or allows emotions to take control.

Drawbacks and Challenges of Using AI Agents

Not built for the unexpected error

In normal conditions, the AI can perform well, but if there are sudden crashes from the market or some other political event, it can cause problems. The AI can be difficult to recover.

Technical failures

If there is no internet, api integration, or a crypto trading bot system goes down. And the AI has stopped functioning. We cannot control or manage the trades.

Adapted to the historical data

Some bots perform well in backtesting but struggle in real-world marketplaces due to differences in conditions.

No human intention

AI cannot feel the market in the same way that experienced traders can. It lacks intuition and the ability to adjust to new situations.

Security concerns

Integrating bots to exchanges requires API keys, which might be problematic if not properly protected.

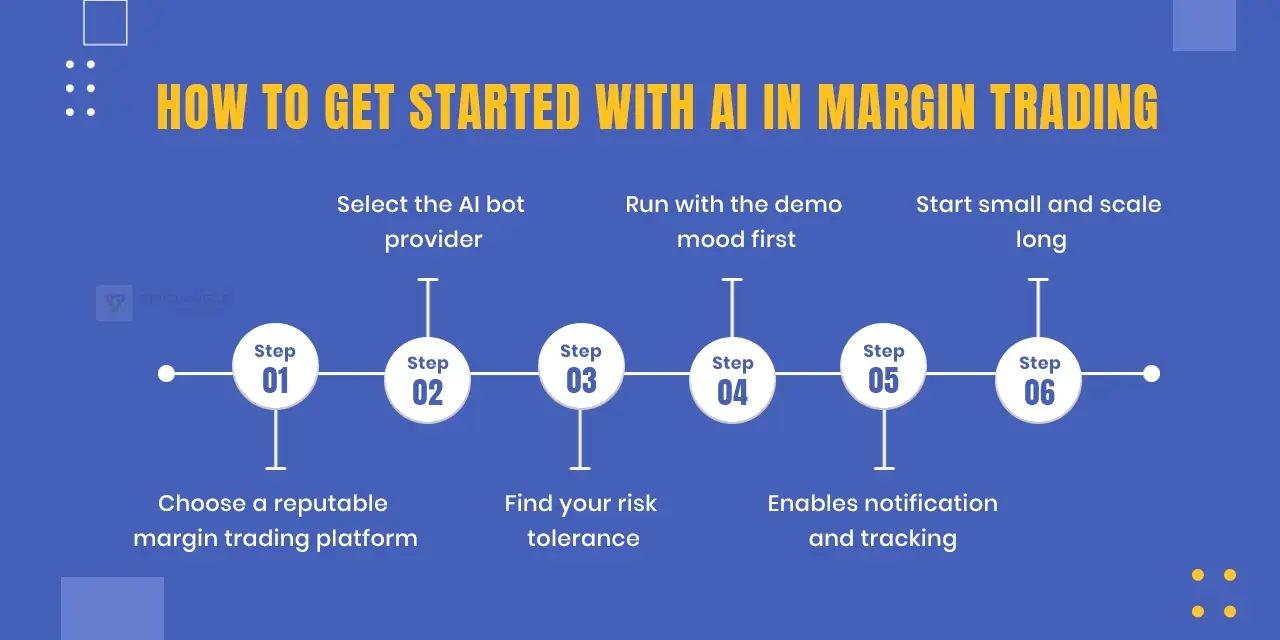

How to Get Started with AI in Margin Trading

Choose a reputable margin trading platform

- First, you can pick the platform with API integration, along with mobile compatibility.

- Like binance, coinbase, Bybit, Kraken, etc.

Select the AI bot provider

- Choose the right AI bot, such as 3Commas, Bitsgap, Kryll, or custom-built tools.

- Search for the user reviews, technical support, and user history, etc.

Find your risk tolerance

- Prevents you from the large leverage, huge drawdown limit, stop-loss orders, etc.

- Monitor your bot, whether they follow in your comfort zone or not.

Run with the demo mood first

- After all implementations, you must test the AI agents’ Margin trading platform.

- Test the complete platform in the demo account, without using real money.

- After that, validate their performance and their strategy.

Enables notification and tracking

- Make the alert message to inform the user whether the trade is prevented in anonymity.

- Every day, you may watch the trade logos and take profit or loss inside the exchange platform.

Start small and scale long

- Begins with low capital and observes the real-time results.

- Scale your platform and upgrade it once a month.

Starting with AI Agents in Margin Trading is a strategic step, but as with any technology tool, it requires careful planning and testing.

Conclusion

AI Agents in Margin Trading add robotics, speed, and smart risk management to the equation. A reliable Cryptocurrency exchange development company can assist traders in eliminating emotional mistakes, using leverage wisely, and improving profit opportunities by integrating these AI-powered solutions. While not flawless, they offer a considerable advantage when paired with proper strategy and monitoring.